Question: Please try to handwrite and show work for the question. 2. Holman Co. began 2019 with 10,000 units in inventory at a cost of $20

Please try to handwrite and show work for the question.

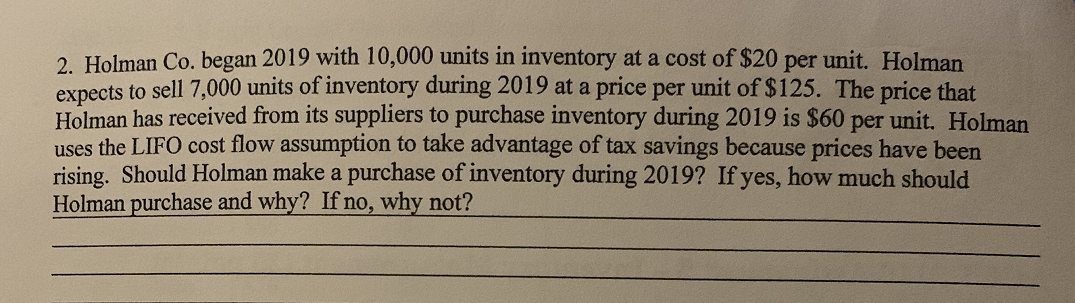

2. Holman Co. began 2019 with 10,000 units in inventory at a cost of $20 per unit. Holman expects to sell 7,000 units of inventory during 2019 at a price per unit of $125. The price that Holman has received from its suppliers to purchase inventory during 2019 is $60 per unit. Holman uses the LIFO cost flow assumption to take advantage of tax savings because prices have been rising. Should Holman make a purchase of inventory during 2019? If yes, how much should Holman purchase and why? If no, why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts