Question: please try to put it into the format in the last picture CHAPTER 7 Internal Control and Cash ust 31 and showed Problem 7-8A Preparing

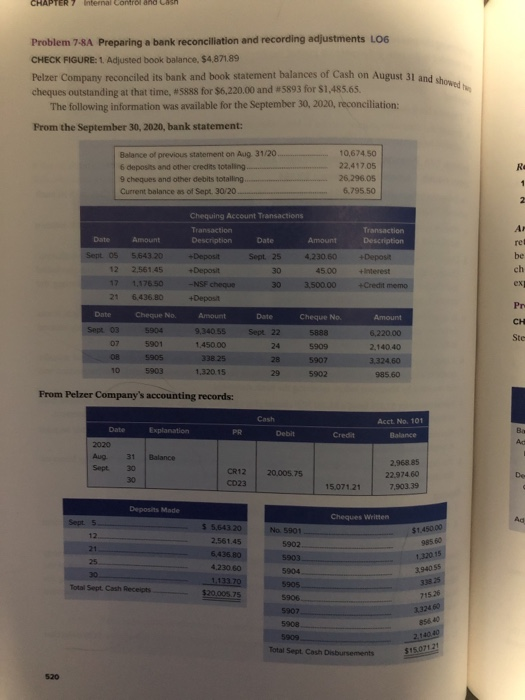

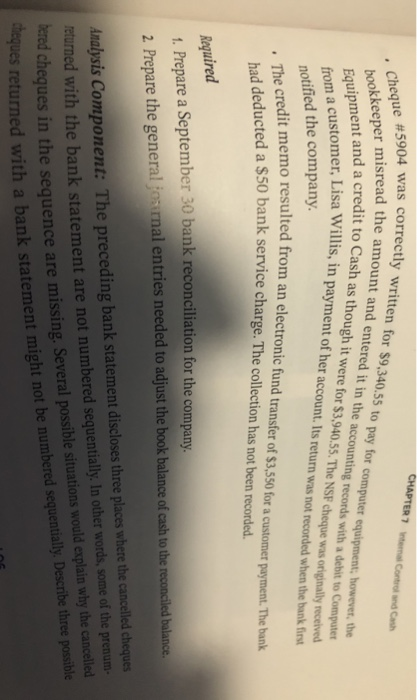

CHAPTER 7 Internal Control and Cash ust 31 and showed Problem 7-8A Preparing a bank reconciliation and recording adjustments LO6 CHECK FIGURE: 1. Adjusted book balance, $4.871.89 Pelzer Company reconciled its bank and book statement balances of Cash on August 31 and cheques outstanding at that time, 888 for $6,220.00 and 5893 for $1,485,65 The following information was available for the September 30, 2020, reconciliation From the September 30, 2020, bank statement: Balance of previous statement on Aug 31/20 6 deposits and other credits totaling 9 cheques and other debits totalling Current balance as of Sept. 30/20 10,674.50 22,417.05 26.296.05 6.795.50 Chequing Account Transactions Date Transaction Description 4 +Deposit Sent 05 12 17 21 Amount 5,643 20 2,56145 1.176.50 6.436.80 Transaction Description Deposit Deposit NSF cheque Deposit Date Sept. 25 30 30 Amount ,230.60 45.00 ,500.00 interest +Credit memo 3 Date Cheque No Sept 03 5904 07 5 901 085905 10 5903 Amount 9.340 55 1.450.00 338 25 1 .320.15 Date Cheque No Sept 22 5888 24 5909 285907 29 5902 Amount 6,220.00 2.140.40 3324.60 985.60 From Pelzer Company's accounting records: Cash Acct No. 101 Date Explanation - PR Debit Credit Balance CR12 CD23 20.005.75 2.968.85 22.97460 7.903.39 15 071 21 Deposits Made Cheques Written $1.450.00 5 60 55.543 20 2.561.45 6,436 80 4.230 60 1.113.70 $20.005.75 394055 Total Sept Cash Receipts No 5901 5902 5903 5904 5905 5906 5907 500B 5909 Total Sept Cash Disbursements 715 26 2.3260 214040 $15.07121 CHAPTER 7 Comh Cheque #5904 wa 4 was correctly written for $9,340.55 to pay for computer equipment; however, the isread the amount and entered it in the accounting records with a debit to Computer d a credit to Cash as though it were for $3,940.55. The NSF cheque was originally received mer, Lisa Willis, in payment of her account. Its return was not recorded when the bank first bookkeeper misread the Equipment and a credit to from a customer, Lisa Wi notified the company. The credit memo resulted from redit memo resulted from an electronic fund transfer of $3,550 for a customer payment. The bank lucted a $50 bank service charge. The collection has not been recorded. Required 1. Prepare a September 30 bank reconciliation for the company. 2. Prepare the general fornal entries needed to adjust the book balance of cash to the reconciled balance Analysis Component: The preceding bank statement discloses three places where the cancelled cheques eurned with the bank statement are not numbered sequentially. In other words, some of the prenum- cheques in the sequence are missing. Several possible situations would explain why the cancelled ned with a bank statement might not be numbered sequentially. Describe three possible Chapter 7 Problem 7-8A Part 1 Chapter Problem 7-8A concrd.) Any component Part 2 GENERAL JOURNAL Date Account Titles and explanation PR Debit Commen by contration Limited. Alserved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts