Question: Please type all answers in Word. Do not include the data downloaded from Website in the Word. Practice 4: Mortgage market 1. Compute the required

Please type all answers in Word. Do not include the data downloaded from Website in the Word.

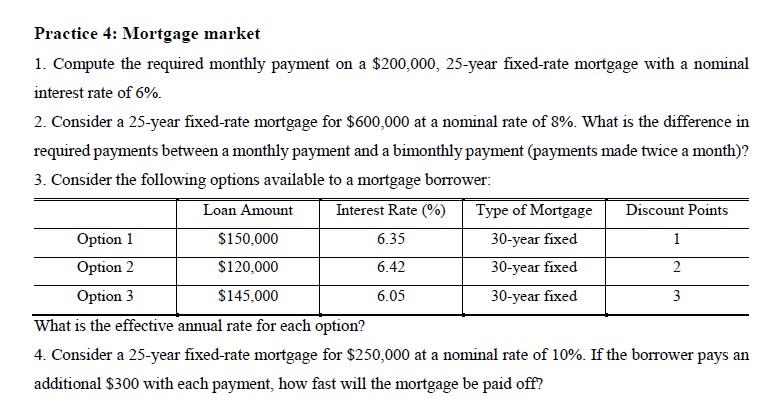

Practice 4: Mortgage market 1. Compute the required monthly payment on a $200,000, 25-year fixed-rate mortgage with a nominal interest rate of 6% 2. Consider a 25-year fixed-rate mortgage for $600,000 at a nominal rate of 8%. What is the difference in required payments between a monthly payment and a bimonthly payment (payments made twice a month)? 3. Consider the following options available to a mortgage borrower: Loan Amount Interest Rate (%) Type of Mortgage Discount Points $150,000 Option 1 6.35 30-year fixed 1 $120,000 6.42 30-year fixed Option 2 2 Option 3 $145,000 6.05 30-year fixed 3 What is the effective annual rate for each option? 4. Consider a 25-year fixed-rate mortgage for $250,000 at a nominal rate of 10%. If the borrower pays an additional $300 with each payment, how fast will the mortgage be paid off

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts