Question: (Please type answer.) Question: What is the total investment for the problem (total outflows)? What are the total cash inflows in year six? What are

(Please type answer.)

Question:

What is the total investment for the problem (total outflows)? What are the total cash inflows in year six? What are the total cash inflows for the six years (ignore time value of money)?

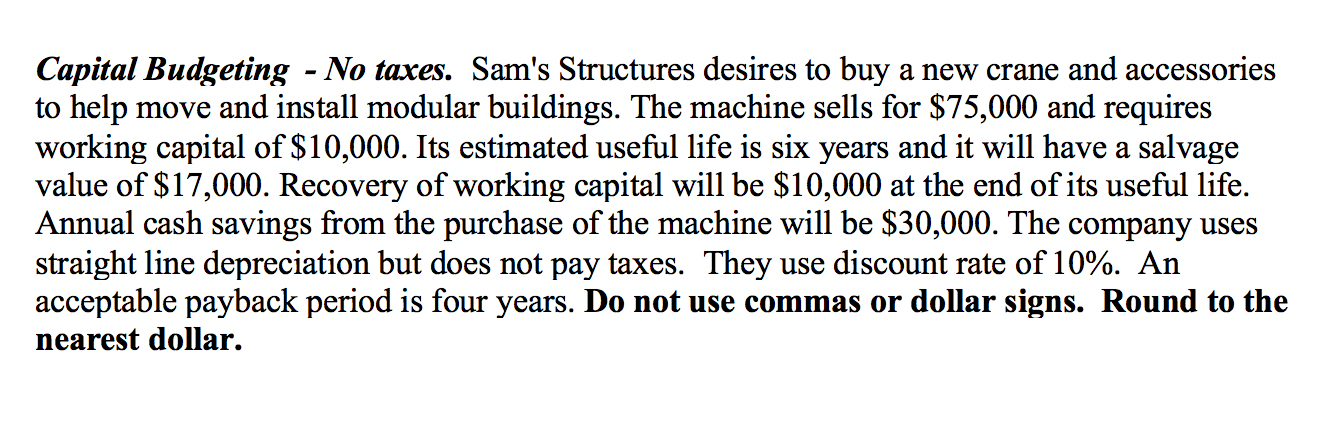

Capital Budgeting - No taxes. Sam's Structures desires to buy a new crane and accessories to help move and install modular buildings. The machine sells for $75,000 and requires working capital of $10,000. Its estimated useful life is six years and it will have a salvage value of $17,000. Recovery of working capital will be $10,000 at the end of its useful life. Annual cash savings from the purchase of the machine will be $30,000. The company uses straight line depreciation but does not pay taxes. They use discount rate of 10%. An acceptable payback period is four years. Do not use commas or dollar signs. Round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts