Question: please type it Following is an excerpt from Target Corporation's most recent 10-k annual report. We sell a wide assortment of general merchandise and food.

please type it

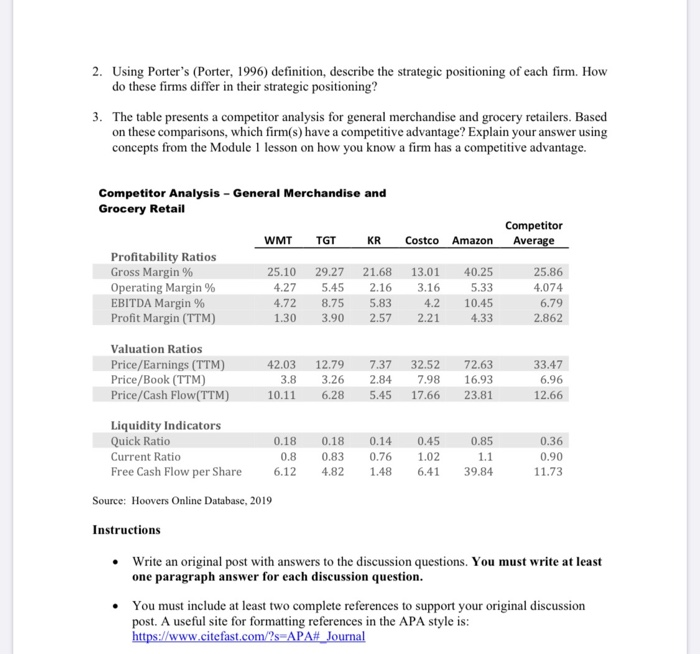

Following is an excerpt from Target Corporation's most recent 10-k annual report. "We sell a wide assortment of general merchandise and food. The majority of our general merchandise stores offer an edited food assortment, including perishables, dry grocery, dairy, and frozen items. Nearly all of our stores larger than 170,000 square feet offer a full line of food items comparable to traditional supermarkets. Our small format stores, generally smaller than 50,000 square feet, offer curated general merchandise and food assortments. Our digital channels include a wide merchandise assortment, including many items found in our stores, along with a complementary assortment. A significant portion of our sales is from national brand merchandise. Approximately one-third of 2019 sales were related to our owned and exclusive brands. We also sell merchandise through periodic exclusive design and creative partnerships and generate revenue from in-store amenities such as Targer Cafe and leased or licensed departments such as Target Optical, Starbucks, and other food service offerings. CVS Pharmacy, Inc. (CVS) operates pharmacies and clinics in our stores under a perpetual operating agreement from which we generate annual occupancy income." Following is an excerpt from Walmart Inc.'s most recent 10-k annual report. "Walmart Inc. ("Walmart," the "Company" or "we") helps people around the world save money and live better - anytime and anywhere - by providing the opportunity to shop in retail stores and through eCommerce. Through innovation, we strive to continuously improve a customer-centric experience that seamlessly integrates our eCommerce and retail stores in an omni-channel offering that saves time for our customers. Each week, we serve over 265 million customers who visit approximately 11,500 stores and numerous eCommerce websites under 56 banners in 27 countries. Our strategy is to make every day easier for busy families, operate with discipline, sharpen our culture, and become digital, and make trust a competitive advantage. Making life easier for busy families includes our commitment to price leadership, which has been and will remain a cornerstone of our business, as well as increasing convenience to save our customers time. By leading on price, we earn the trust of our customers every day by providing a broad assortment of quality merchandise and services at everyday low prices ("EDLP"). EDLP is our pricing philosophy under which we price items at a low price every day so our customers trust that our prices will not change under frequent promotional activity. Everyday low cost ("EDLC") is our commitment to control expenses so our cost savings can be passed along to our customers." Use the above information, the definition of strategy and strategic positioning outlined in the lecture "What is Strategy?" and conduct additional research as needed to answer the discussion questions. 1. Identify the unique elements of Target's and Walmart's strategies. How do these two firms strategies differ? 2. Using Porter's (Porter, 1996) definition, describe the strategic positioning of each firm. How do these firms differ in their strategic positioning? 3. The table presents a competitor analysis for general merchandise and grocery retailers. Based on these comparisons, which firm(s) have a competitive advantage? Explain your answer using concepts from the Module 1 lesson on how you know a firm has a competitive advantage. Competitor Analysis - General Merchandise and Grocery Retail Competitor Average WMT TGT KR Costco Amazon 25.86 Profitability Ratios Gross Margin % Operating Margin % EBITDA Margin % Profit Margin (TTM) 25.10 4.27 4.72 1.30 29.27 5.45 8.75 3.90 4.074 21.68 2.16 5.83 2.57 13.01 3.16 4.2 2.21 40.25 5.33 10.45 4.33 6.79 2.862 Valuation Ratios Price/Earnings (TTM) Price/Book (TTM) Price/Cash Flow(TTM) 42.03 3.8 10.11 12.79 3.26 6.28 7.37 2.84 5.45 32.52 7.98 17.66 72.63 16.93 23.81 33.47 6.96 12.66 0.8 Liquidity Indicators Quick Ratio 0.18 Current Ratio Free Cash Flow per Share Source: Hoovers Online Database, 2019 0.18 0.83 4.82 0.14 0.76 1.48 0.45 1.02 6.41 0.85 1.1 39.84 0.36 0.90 11.73 6.12 Instructions Write an original post with answers to the discussion questions. You must write at least one paragraph answer for each discussion question. You must include at least two complete references to support your original discussion post. A useful site for formatting references in the APA style is: https://www.citefast.com/?s=APA# Journal Following is an excerpt from Target Corporation's most recent 10-k annual report. "We sell a wide assortment of general merchandise and food. The majority of our general merchandise stores offer an edited food assortment, including perishables, dry grocery, dairy, and frozen items. Nearly all of our stores larger than 170,000 square feet offer a full line of food items comparable to traditional supermarkets. Our small format stores, generally smaller than 50,000 square feet, offer curated general merchandise and food assortments. Our digital channels include a wide merchandise assortment, including many items found in our stores, along with a complementary assortment. A significant portion of our sales is from national brand merchandise. Approximately one-third of 2019 sales were related to our owned and exclusive brands. We also sell merchandise through periodic exclusive design and creative partnerships and generate revenue from in-store amenities such as Targer Cafe and leased or licensed departments such as Target Optical, Starbucks, and other food service offerings. CVS Pharmacy, Inc. (CVS) operates pharmacies and clinics in our stores under a perpetual operating agreement from which we generate annual occupancy income." Following is an excerpt from Walmart Inc.'s most recent 10-k annual report. "Walmart Inc. ("Walmart," the "Company" or "we") helps people around the world save money and live better - anytime and anywhere - by providing the opportunity to shop in retail stores and through eCommerce. Through innovation, we strive to continuously improve a customer-centric experience that seamlessly integrates our eCommerce and retail stores in an omni-channel offering that saves time for our customers. Each week, we serve over 265 million customers who visit approximately 11,500 stores and numerous eCommerce websites under 56 banners in 27 countries. Our strategy is to make every day easier for busy families, operate with discipline, sharpen our culture, and become digital, and make trust a competitive advantage. Making life easier for busy families includes our commitment to price leadership, which has been and will remain a cornerstone of our business, as well as increasing convenience to save our customers time. By leading on price, we earn the trust of our customers every day by providing a broad assortment of quality merchandise and services at everyday low prices ("EDLP"). EDLP is our pricing philosophy under which we price items at a low price every day so our customers trust that our prices will not change under frequent promotional activity. Everyday low cost ("EDLC") is our commitment to control expenses so our cost savings can be passed along to our customers." Use the above information, the definition of strategy and strategic positioning outlined in the lecture "What is Strategy?" and conduct additional research as needed to answer the discussion questions. 1. Identify the unique elements of Target's and Walmart's strategies. How do these two firms strategies differ? 2. Using Porter's (Porter, 1996) definition, describe the strategic positioning of each firm. How do these firms differ in their strategic positioning? 3. The table presents a competitor analysis for general merchandise and grocery retailers. Based on these comparisons, which firm(s) have a competitive advantage? Explain your answer using concepts from the Module 1 lesson on how you know a firm has a competitive advantage. Competitor Analysis - General Merchandise and Grocery Retail Competitor Average WMT TGT KR Costco Amazon 25.86 Profitability Ratios Gross Margin % Operating Margin % EBITDA Margin % Profit Margin (TTM) 25.10 4.27 4.72 1.30 29.27 5.45 8.75 3.90 4.074 21.68 2.16 5.83 2.57 13.01 3.16 4.2 2.21 40.25 5.33 10.45 4.33 6.79 2.862 Valuation Ratios Price/Earnings (TTM) Price/Book (TTM) Price/Cash Flow(TTM) 42.03 3.8 10.11 12.79 3.26 6.28 7.37 2.84 5.45 32.52 7.98 17.66 72.63 16.93 23.81 33.47 6.96 12.66 0.8 Liquidity Indicators Quick Ratio 0.18 Current Ratio Free Cash Flow per Share Source: Hoovers Online Database, 2019 0.18 0.83 4.82 0.14 0.76 1.48 0.45 1.02 6.41 0.85 1.1 39.84 0.36 0.90 11.73 6.12 Instructions Write an original post with answers to the discussion questions. You must write at least one paragraph answer for each discussion question. You must include at least two complete references to support your original discussion post. A useful site for formatting references in the APA style is: https://www.citefast.com/?s=APA# Journal