Question: Please type out the cell numbers and formulas used in the yellow spaces D A B 1 To aid in planning, Jay Corporation is preparing

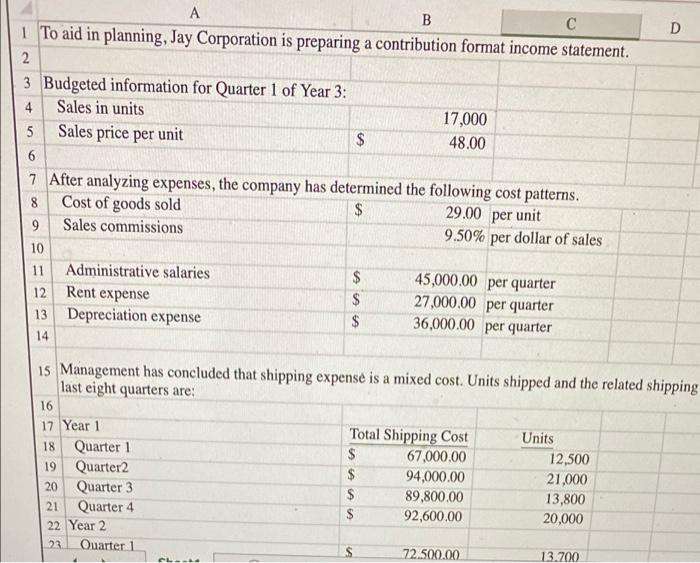

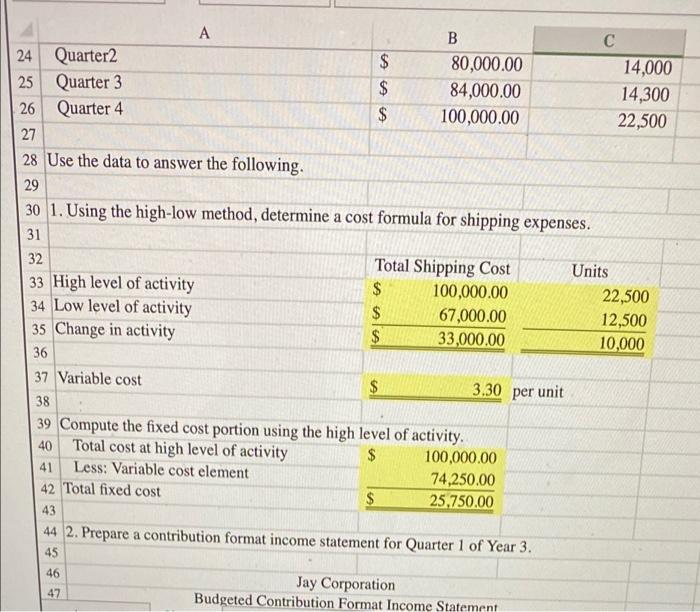

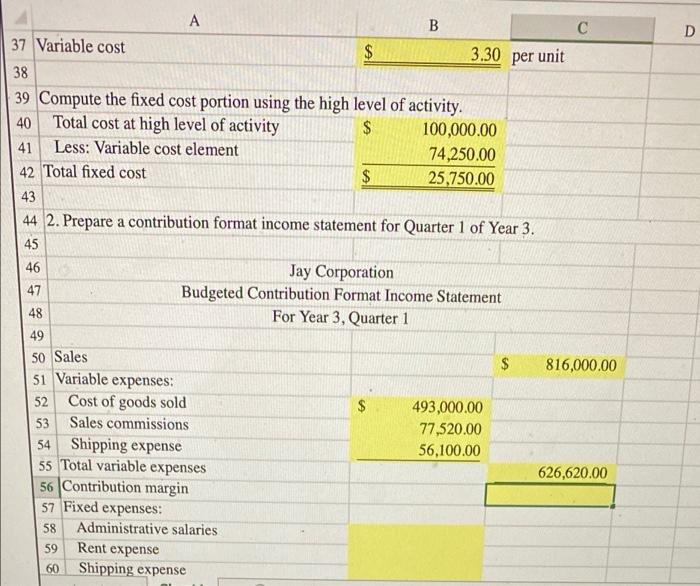

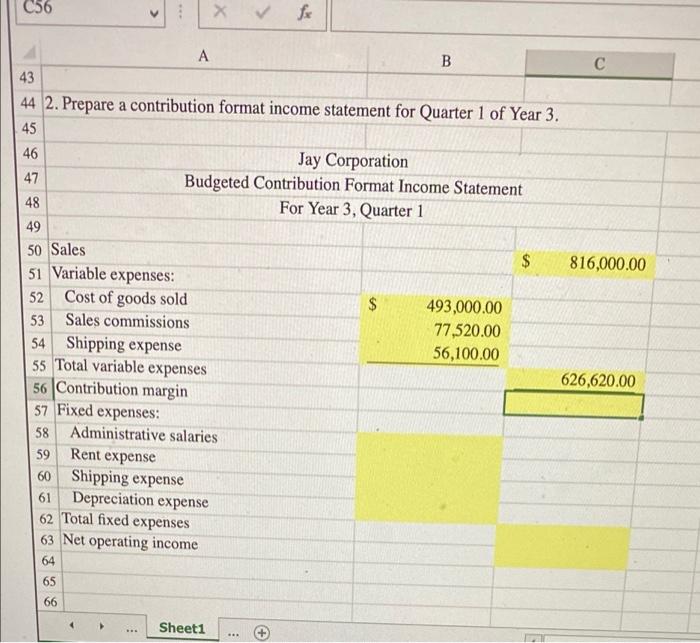

D A B 1 To aid in planning, Jay Corporation is preparing a contribution format income statement. 2 3 Budgeted information for Quarter 1 of Year 3: 4 Sales in units 17,000 5 Sales price per unit $ 48.00 6 7 After analyzing expenses, the company has determined the following cost patterns. 8 Cost of goods sold $ 29.00 per unit 9 Sales commissions 9.50% per dollar of sales 10 11 Administrative salaries $ 45,000.00 per quarter 12 $ 27,000.00 per quarter 13 Depreciation expense $ 36,000.00 per quarter 14 Rent expense 15 Management has concluded that shipping expense is a mixed cost. Units shipped and the related shipping last eight quarters are: 16 17 Year 1 Total Shipping Cost Units 18 Quarter 1 $ 67,000.00 12,500 19 Quarter2 $ 94,000.00 21,000 20 Quarter 3 $ 89,800.00 13,800 21 Quarter 4 $ 92,600.00 20,000 22 Year 2 Quarter 1 72.500.00 13.700 23 S CL- A A B 24 Quarter2 $ 80,000.00 14,000 25 Quarter 3 $ 84,000.00 14,300 26 Quarter 4 $ 100,000.00 22,500 27 28 Use the data to answer the following. 29 30 1. Using the high-low method, determine a cost formula for shipping expenses. 31 32 Total Shipping Cost Units 33 High level of activity $ 100,000.00 22,500 34 Low level of activity $ 67,000.00 12,500 35 Change in activity $ 33,000.00 10,000 36 37 Variable cost 3.30 per unit 38 39 Compute the fixed cost portion using the high level of activity. Total cost at high level of activity $ 100,000.00 41 Less: Variable cost element 74,250.00 42 Total fixed cost $ 25,750.00 43 44 2. Prepare a contribution format income statement for Quarter 1 of Year 3. 45 46 Jay Corporation 47 Budgeted Contribution Format Income Statement $ 40 D Al B 37 Variable cost $ 3.30 per unit 38 39 Compute the fixed cost portion using the high level of activity. 40 Total cost at high level of activity $ 100,000.00 41 Less: Variable cost element 74,250.00 42 Total fixed cost 25,750.00 43 44 2. Prepare a contribution format income statement for Quarter 1 of Year 3. 45 46 Jay Corporation 47 Budgeted Contribution Format Income Statement For Year 3, Quarter 1 49 50 Sales $ 816,000.00 51 Variable expenses: 52 Cost of goods sold $ 493,000.00 53 Sales commissions 77,520.00 54 Shipping expense 56,100.00 55 Total variable expenses 626,620.00 56 Contribution margin 57 Fixed expenses: 58 Administrative salaries 59 Rent expense 60 Shipping expense 48 C56 816,000.00 A B 43 44 2. Prepare a contribution format income statement for Quarter 1 of Year 3. 45 46 Jay Corporation 47 Budgeted Contribution Format Income Statement 48 For Year 3, Quarter 1 49 50 Sales $ 51 Variable expenses: 52 Cost of goods sold $ 493,000.00 53 Sales commissions 77,520.00 54 Shipping expense 56,100.00 55 Total variable expenses 56 Contribution margin 57 Fixed expenses: 58 Administrative salaries 59 60 Shipping expense 61 Depreciation expense 62 Total fixed expenses 63 Net operating income 64 65 66 626,620.00 Rent expense Sheet1 .. +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts