Question: please type Question 4 (25 marks) Sinclair Ltd provides for depreciation on its machinery at 20% per annum on cost: it charges for full year

please type

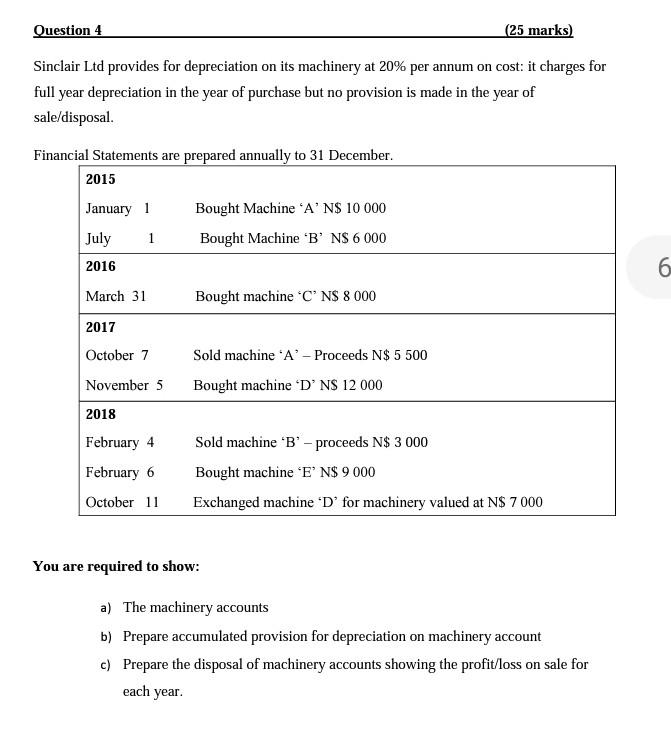

Question 4 (25 marks) Sinclair Ltd provides for depreciation on its machinery at 20% per annum on cost: it charges for full year depreciation in the year of purchase but no provision is made in the year of sale/disposal. Financial Statements are prepared annually to 31 December. 2015 January 1 Bought Machine 'A' N$ 10 000 July Bought Machine 'B' N$ 6 000 2016 March 31 Bought machine 'C' NS 8 000 2017 October 7 Sold machine 'A' - Proceeds N$ 5 500 November 5 Bought machine 'D' N$ 12 000 2018 February 4 Sold machine 'B' - proceeds N$ 3 000 February 6 Bought machine 'E' N$ 9 000 October 11 Exchanged machine 'D' for machinery valued at N$ 7000 You are required to show: a) The machinery accounts b) Prepare accumulated provision for depreciation on machinery account c) Prepare the disposal of machinery accounts showing the profit/loss on sale for each year. 1 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts