Question: Please type the answer as handwriting are hard to read at times. thank you Question 51 10 pts A business issued a 120-day, 6% note

Please type the answer as handwriting are hard to read at times. thank you

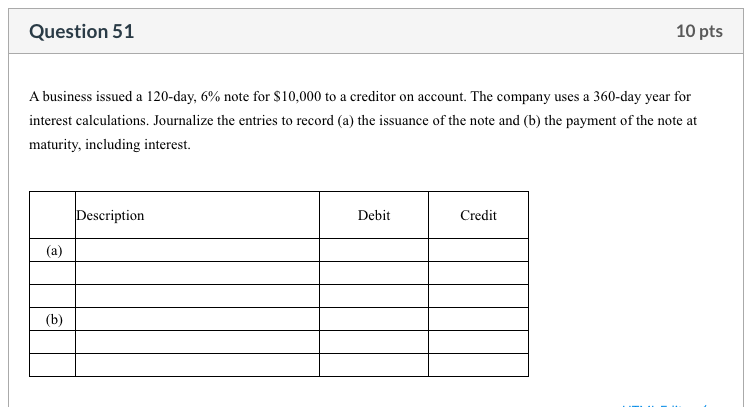

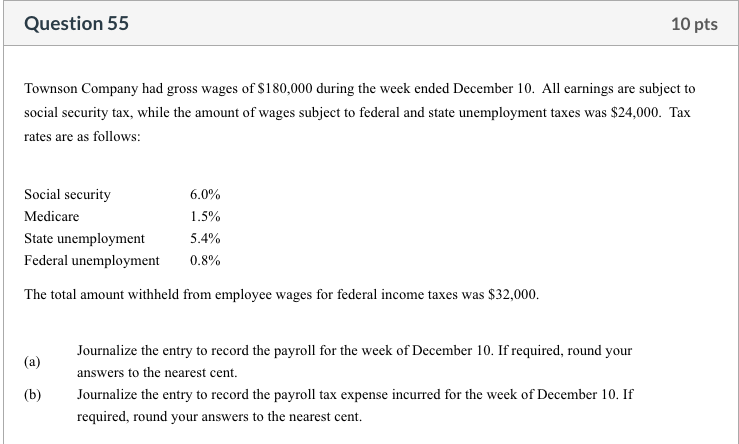

Question 51 10 pts A business issued a 120-day, 6% note for $10,000 to a creditor on account. The company uses a 360-day year for interest calculations. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Description Debit Credit Question 55 10 pts Townson Company had gross wages of $180,000 during the week ended December 10. All earnings are subject to social security tax, while the amount of wages subject to federal and state unemployment taxes was $24,000. Tax rates are as follows: Social security Medicare State unemployment Federal unemployment 6.0% 1.5% 5.4% 0.8% The total amount withheld from employee wages for federal income taxes was $32,000. Journalize the entry to record the payroll for the week of December 10. If required, round your answers to the nearest cent. Journalize the entry to record the payroll tax expense incurred for the week of December 10. If required, round your answers to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts