Question: please type the answer by computer dont write it by hand 1:10-34 Straight-Line Depreciation. Bobby's marginal tax rate has been low for several years be-

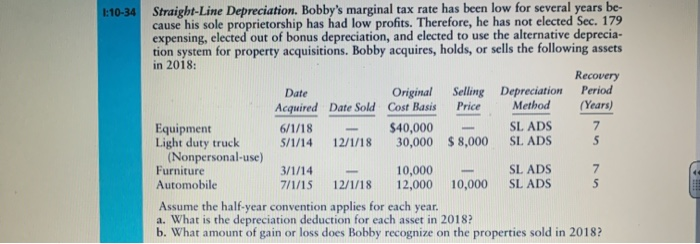

1:10-34 Straight-Line Depreciation. Bobby's marginal tax rate has been low for several years be- cause his sole proprietorship has had low profits. Therefore, he has not elected Sec. 179 expensing, elected out of bonus depreciation, and elected to use the alternative deprecia- tion system for property acquisitions. Bobby acquires, holds, or sells the following assets in 2018: Recovery Date Original Selling Depreciation Period Acquired Date Sold Cost Basis Price Method (Years) Equipment 6/1/18 $40,000 SL ADS 7 Light duty truck 5/1/14 12/1/18 30,000 $8,000 SL ADS 5 (Nonpersonal use) Furniture 3/1/14 10,000 SL ADS 7 Automobile 7/1/15 12/1/18 12,000 10,000 SL ADS 5 Assume the half-year convention applies for each year. a. What is the depreciation deduction for each asset in 2018? b. What amount of gain or loss does Bobby recognize on the properties sold in 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts