Question: Please type the answer by computer, so i can see it clearly, thank you!! A hedge fund agreed to pay the Hang Seng TECH Index

Please type the answer by computer, so i can see it clearly, thank you!!

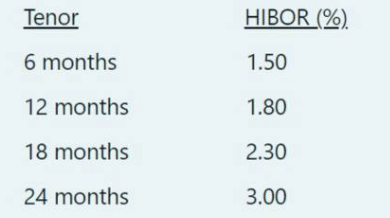

A hedge fund agreed to pay the Hang Seng TECH Index return in exchange for a fixed rate in a two-year equity swap with a notional of $10 million. The payments were made on a 30/360 basis every two years. The index hit support at 4,600 when the swap was started, and the HIBOR term structure was as follows:

Questions:

1(a) Determine the initial value and the swap rate.

1(b) The index moved up to 5,000 after 6months. Calculate the first net payment on the swap from the perspective of the hedge fund

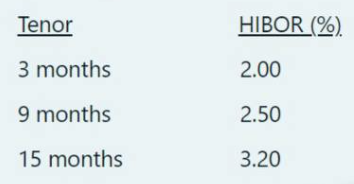

1(c) It is now 9 moths into the life of the swap. Calculate the value of the swap provided that the index bounced back to 4,650 and the term structure of HIBOR has been updated as follows

Tenor HIBOR (%). 6 months 1.50 12 months 1.80 18 months 2.30 24 months 3.00 Tenor HIBOR (%). 3 months 2.00 9 months 2.50 15 months 3.20 Tenor HIBOR (%). 6 months 1.50 12 months 1.80 18 months 2.30 24 months 3.00 Tenor HIBOR (%). 3 months 2.00 9 months 2.50 15 months 3.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts