Question: please type the answer by computer, so i can see it clearly, thank you!!! You work as an investment analyst for a securities firm, and

please type the answer by computer, so i can see it clearly, thank you!!!

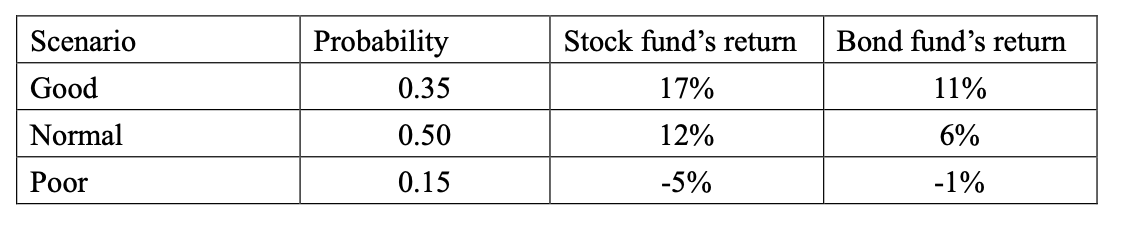

You work as an investment analyst for a securities firm, and your boss has conducted a scenario analysis on the future performance of a stock fund and a bond fund:

Question:

1(a) Calculate the expected returns and standard deviations of both funds.

After you present the expected returns and standard deviations of both funds to your supervisor, he would like to know the minimum variance portfolio if the correlation coefficient between their rates of returns is -0.10.

1(b) Calculate the weightings invested in each of the two funds, expected returns and the standard deviation of the minimum variance portfolio.

1(c) Your boss wants to put together an ideal risky portfolio using the two funds described above, with a risk-free rate of 2.0 percent.

Calculate the weightings invested in each of the two funds, the expected returns and the standard deviation of the optimal risky portfolio.

1(d) Calculate the Sharpe ratio of the optimal risky portfolio.

Scenario Stock fund's return Bond fund's return Probability 0.35 Good 17% Normal 0.50 12% 11% 6% -1% Poor 0.15 -5% Scenario Stock fund's return Bond fund's return Probability 0.35 Good 17% Normal 0.50 12% 11% 6% -1% Poor 0.15 -5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts