Question: please type the answer by computer, so I can see it clearly, thank you!!! You intend to purchase a house for $4,500,000 with a Lion

please type the answer by computer, so I can see it clearly, thank you!!!

You intend to purchase a house for $4,500,000 with a Lion Bank 15-year mortgage. The mortgage rate that you have been given is fixed at 6.5 percent per year. You will pay 20% of the total purchase price as a down payment.

You have provided the following information to Lion Bank's credit officer in order to apply for a mortgage loan:

Annual property taxes: $12,000; Annual insurance payment: $8,000; Monthly repayment of personal loan: $650; Annual gross income: $950,000

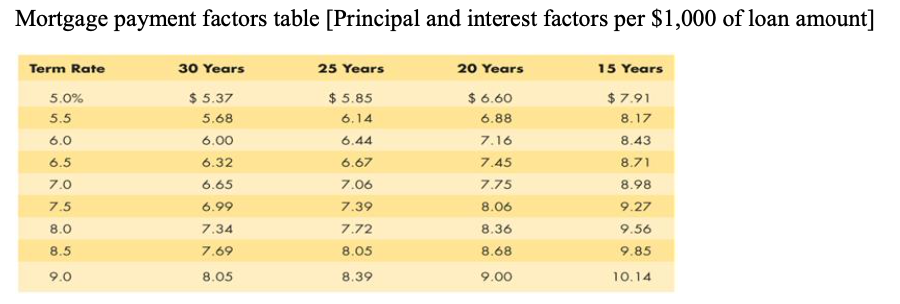

(1a) Calculate the monthly mortgage payment (use the table below)

(1b) Calculate Gross Debt Service ratio (GDS) and Total Debt Service Ratio (TDS) respectively

(1c) If the GDS and TDS thresholds are 40% and 45% respectively, what are the two adjustments you can do to qualify for the banks mortgage?

Mortgage payment factors table [Principal and interest factors per $1,000 of loan amount] Term Rate 25 Years 20 Years 15 Years 5.0% 5.5 6.0 $ 5.85 6.14 6.44 6.5 30 Years $5.37 5.68 6.00 6.32 6.65 6.99 7.34 7.69 6.67 7.06 $ 6.60 6.88 7.16 7.45 7.75 8.06 8.36 $7.91 8.17 8.43 8.71 8.98 9.27 9.56 9.85 7.0 7.5 7.39 8.0 7.72 8.05 8.5 8.68 9.0 8.05 8.39 9.00 10.14 Mortgage payment factors table [Principal and interest factors per $1,000 of loan amount] Term Rate 25 Years 20 Years 15 Years 5.0% 5.5 6.0 $ 5.85 6.14 6.44 6.5 30 Years $5.37 5.68 6.00 6.32 6.65 6.99 7.34 7.69 6.67 7.06 $ 6.60 6.88 7.16 7.45 7.75 8.06 8.36 $7.91 8.17 8.43 8.71 8.98 9.27 9.56 9.85 7.0 7.5 7.39 8.0 7.72 8.05 8.5 8.68 9.0 8.05 8.39 9.00 10.14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts