Question: Please type the answer by computer so I can see it clearly, thank you!!!! Assume it's the end of 2021, and you've been provided the

Please type the answer by computer so I can see it clearly, thank you!!!!

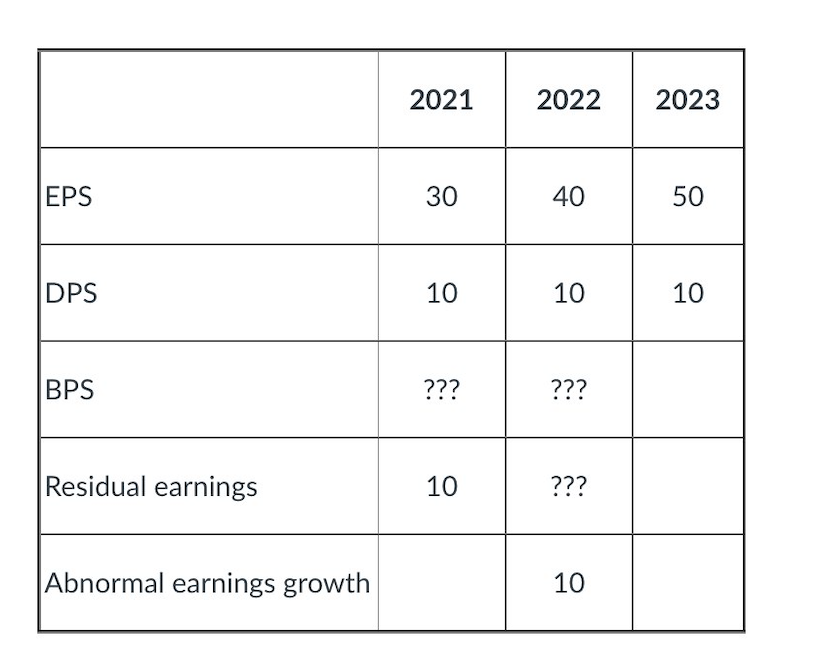

Assume it's the end of 2021, and you've been provided the following information about EFG Inc.'s common shares (the 2022 and 2023 numbers are estimates). Assume that EFG Inc. has a 10% cost of equity.

1(a) Calculate EFG's book value of equity per share (BPS) for 2021 and 2022.

1(a) Calculate EFG's book value of equity per share (BPS) for 2021 and 2022.

1(b) Assume that after 2023, EFG's abnormal earnings growth(AEG) will grow at a constant growth rate of 3% forever. Calculate the intrinsic value per share at the end of year 2021.

1(c) Assume that EFG's abnormal earnings growth (AEG) will continue to grow at a steady rate after 2023. Calculate the market implied EPS prediction for 2024 based on EFG's current stock price of $2150 per share.

2021 2022 2023 EPS 30 40 50 DPS 10 10 10 BPS ??? ??? Residual earnings 10 ??? Abnormal earnings growth 10 2021 2022 2023 EPS 30 40 50 DPS 10 10 10 BPS ??? ??? Residual earnings 10 ??? Abnormal earnings growth 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts