Question: Please type the answer by computer so I can see it clearly, thank you!!! T-Toys Ltd has engaged Mr Cheung as a marketing manager since

Please type the answer by computer so I can see it clearly, thank you!!!

T-Toys Ltd has engaged Mr Cheung as a marketing manager since 2016. T-Toys Ltd is a Hong Kong-based firm that specializes in toy trading. Mr. Cheung was compelled to go regularly to China because T-Toys Ltd's primary clients are based there. For the fiscal year ending March 31, 2021, he presents the following data:

information maybe needed:

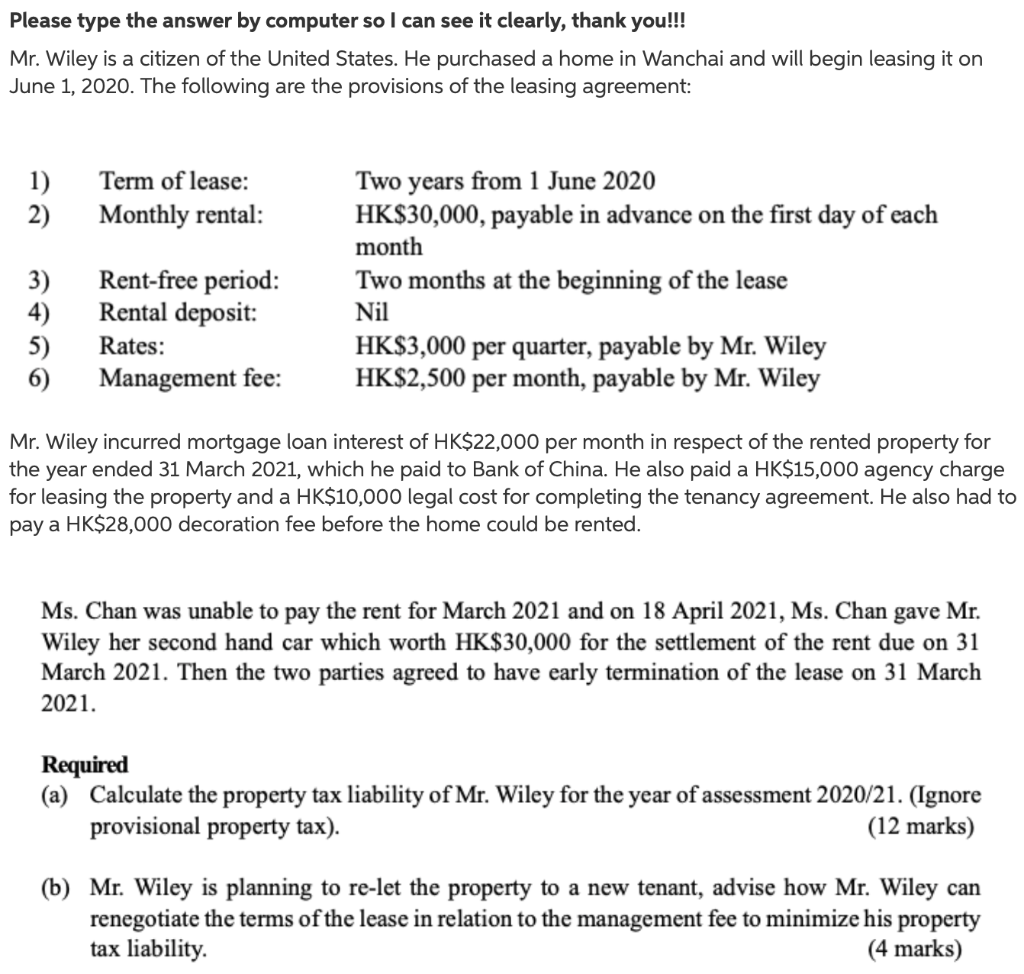

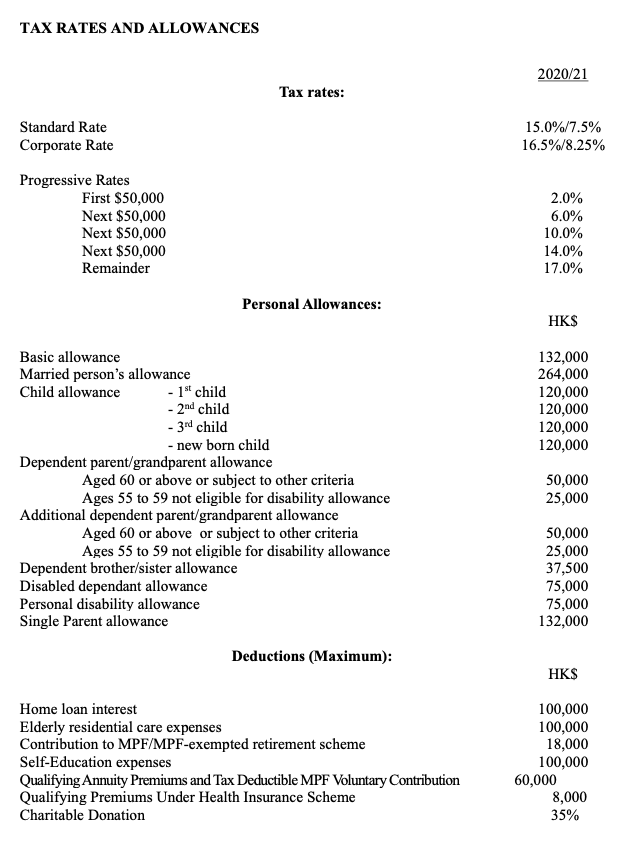

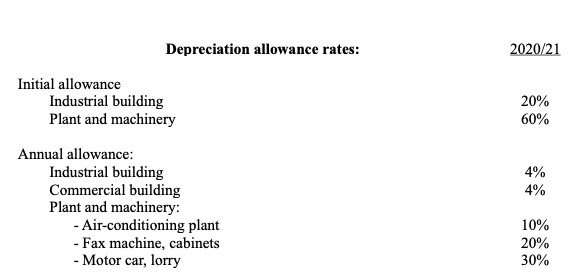

Please type the answer by computer so I can see it clearly, thank you!!! Mr. Wiley is a citizen of the United States. He purchased a home in Wanchai and will begin leasing it on June 1, 2020. The following are the provisions of the leasing agreement: 1) Term of lease: Two years from 1 June 2020 2) Monthly rental: HK$30,000, payable in advance on the first day of each month 3) Rent-free period: Rental deposit: Two months at the beginning of the lease Nil 4) 5) Rates: HK$3,000 per quarter, payable by Mr. Wiley HK$2,500 per month, payable by Mr. Wiley 6) Management fee: Mr. Wiley incurred mortgage loan interest of HK$22,000 per month in respect of the rented property for the year ended 31 March 2021, which he paid to Bank of China. He also paid a HK$15,000 agency charge for leasing the property and a HK$10,000 legal cost for completing the tenancy agreement. He also had to pay a HK$28,000 decoration fee before the home could be rented. Ms. Chan was unable to pay the rent for March 2021 and on 18 April 2021, Ms. Chan gave Mr. Wiley her second hand car which worth HK$30,000 for the settlement of the rent due on 31 March 2021. Then the two parties agreed to have early termination of the lease on 31 March 2021. Required (a) Calculate the property tax liability of Mr. Wiley for the year of assessment 2020/21. (Ignore provisional property tax). (12 marks) (b) Mr. Wiley is planning to re-let the property to a new tenant, advise how Mr. Wiley can renegotiate the terms of the lease in relation to the management fee to minimize his property tax liability. (4 marks) TAX RATES AND ALLOWANCES Standard Rate Corporate Rate Progressive Rates Tax rates: First $50,000 Next $50,000 Next $50,000 Next $50,000 Remainder Personal Allowances: Basic allowance Married person's allowance Child allowance - 1st child - 2nd child - 3rd child - new born child Dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Additional dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Dependent brother/sister allowance Disabled dependant allowance Personal disability allowance Single Parent allowance Deductions (Maximum): Home loan interest Elderly residential care expenses Contribution to MPF/MPF-exempted retirement scheme Self-Education expenses Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contribution Qualifying Premiums Under Health Insurance Scheme Charitable Donation 2020/21 15.0%/7.5% 16.5%/8.25% 2.0% 6.0% 10.0% 14.0% 17.0% HK$ 132,000 264,000 120,000 120,000 120,000 120,000 50,000 25,000 50,000 25,000 37,500 75,000 75,000 132,000 HK$ 100,000 100,000 18,000 100,000 8,000 35% 60,000 Initial allowance Annual allowance: Depreciation allowance rates: Industrial building Plant and machinery Industrial building Commercial building Plant and machinery: - Air-conditioning plant - Fax machine, cabinets - Motor car, lorry 2020/21 20% 60% 4% 4% 10% 20% 30% Please type the answer by computer so I can see it clearly, thank you!!! Mr. Wiley is a citizen of the United States. He purchased a home in Wanchai and will begin leasing it on June 1, 2020. The following are the provisions of the leasing agreement: 1) Term of lease: Two years from 1 June 2020 2) Monthly rental: HK$30,000, payable in advance on the first day of each month 3) Rent-free period: Rental deposit: Two months at the beginning of the lease Nil 4) 5) Rates: HK$3,000 per quarter, payable by Mr. Wiley HK$2,500 per month, payable by Mr. Wiley 6) Management fee: Mr. Wiley incurred mortgage loan interest of HK$22,000 per month in respect of the rented property for the year ended 31 March 2021, which he paid to Bank of China. He also paid a HK$15,000 agency charge for leasing the property and a HK$10,000 legal cost for completing the tenancy agreement. He also had to pay a HK$28,000 decoration fee before the home could be rented. Ms. Chan was unable to pay the rent for March 2021 and on 18 April 2021, Ms. Chan gave Mr. Wiley her second hand car which worth HK$30,000 for the settlement of the rent due on 31 March 2021. Then the two parties agreed to have early termination of the lease on 31 March 2021. Required (a) Calculate the property tax liability of Mr. Wiley for the year of assessment 2020/21. (Ignore provisional property tax). (12 marks) (b) Mr. Wiley is planning to re-let the property to a new tenant, advise how Mr. Wiley can renegotiate the terms of the lease in relation to the management fee to minimize his property tax liability. (4 marks) TAX RATES AND ALLOWANCES Standard Rate Corporate Rate Progressive Rates Tax rates: First $50,000 Next $50,000 Next $50,000 Next $50,000 Remainder Personal Allowances: Basic allowance Married person's allowance Child allowance - 1st child - 2nd child - 3rd child - new born child Dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Additional dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Dependent brother/sister allowance Disabled dependant allowance Personal disability allowance Single Parent allowance Deductions (Maximum): Home loan interest Elderly residential care expenses Contribution to MPF/MPF-exempted retirement scheme Self-Education expenses Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contribution Qualifying Premiums Under Health Insurance Scheme Charitable Donation 2020/21 15.0%/7.5% 16.5%/8.25% 2.0% 6.0% 10.0% 14.0% 17.0% HK$ 132,000 264,000 120,000 120,000 120,000 120,000 50,000 25,000 50,000 25,000 37,500 75,000 75,000 132,000 HK$ 100,000 100,000 18,000 100,000 8,000 35% 60,000 Initial allowance Annual allowance: Depreciation allowance rates: Industrial building Plant and machinery Industrial building Commercial building Plant and machinery: - Air-conditioning plant - Fax machine, cabinets - Motor car, lorry 2020/21 20% 60% 4% 4% 10% 20% 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts