Question: Please type the answer by computer, so i can see it clearly, thank you!!!! The Chinese medication manufacturer proposes to offer the Hong Kong drug

Please type the answer by computer, so i can see it clearly, thank you!!!!

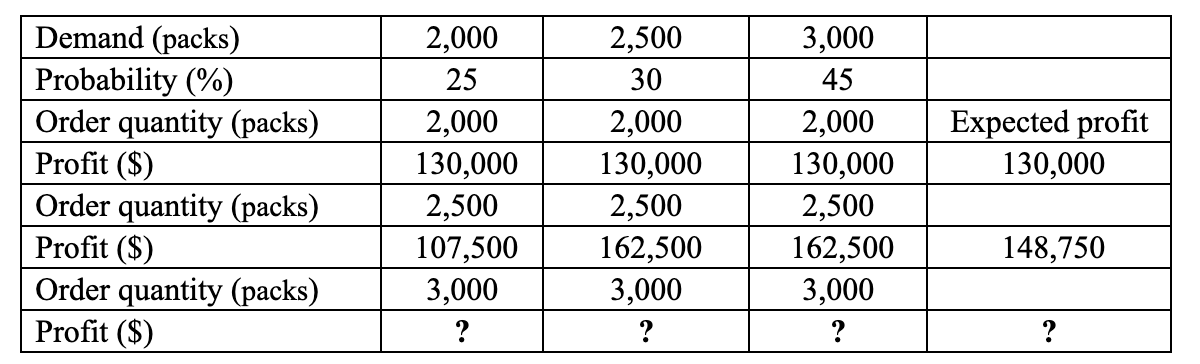

The Chinese medication manufacturer proposes to offer the Hong Kong drug store a BUY-BACK contract in which the manufacturer will buy unsold LH capsules from the drug store for $10 per pack in order to induce the drug store to place a larger order. The wholesale price, as well as fixed and variable production expenses, stay unchanged for the manufacturer. With this buy-back contract, the drug store has calculated the expected profits for various order quantities (see the table below).

1(a) Based on the buy-back contract, determine the drug stores expected profit if the order quantity is 3,000 packs, and determine the optimal order quantity that will maximize the drug stores profit.

1(a) Based on the buy-back contract, determine the drug stores expected profit if the order quantity is 3,000 packs, and determine the optimal order quantity that will maximize the drug stores profit.

1(b) If the drug store adopts the optimal order quantity of Q1(a), determine the manufacturers expected profit.

1(c) Describe TWO drawbacks of using the buy-back contract in this case.

Expected profit 130,000 Demand (packs) Probability (%) Order quantity (packs) Profit ($) Order quantity (packs) Profit ($) Order quantity (packs) Profit ($) 2,000 25 2,000 130,000 2,500 107,500 3,000 ? 2,500 30 2,000 130,000 2,500 162,500 3,000 ? 3,000 45 2,000 130,000 2,500 162,500 3,000 ? 148,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts