Question: Please type the Answers cleary!! ITS ONLY ONE PROBLEM! Thank you! Check my work mode: This shows what is correct or incorrect for the work

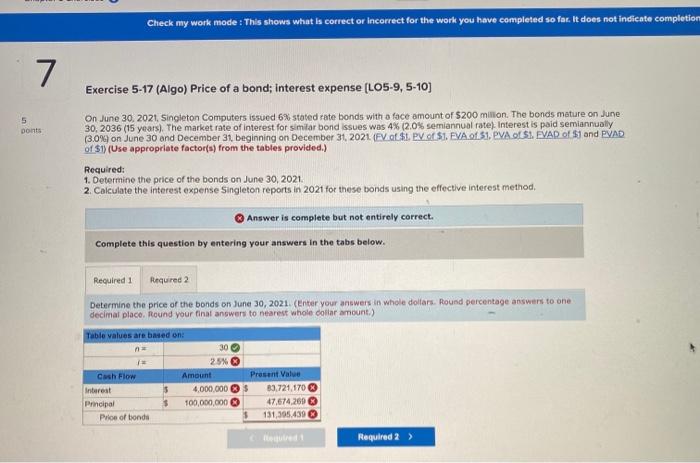

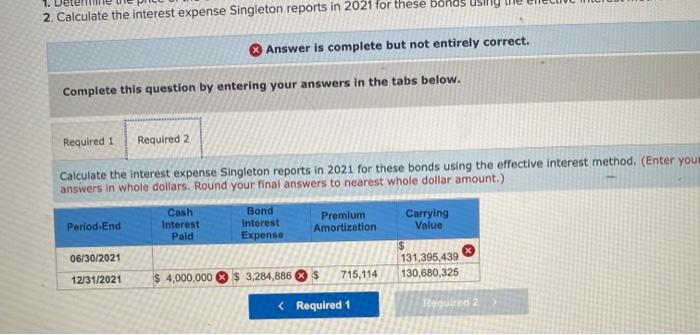

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion 7 Exercise 5-17 (Algo) Price of a bond; interest expense (LO5-9, 5-10] 5 ponts On June 30, 2021. Singleton Computers issued 6% stated rate bonds with a face amount of $200 million. The bonds mature on June 30, 2036 (15 years). The market rate of interest for similar bond issues was 4% (2.0% semiannual rate). Interest is paid semiannually (3.0%) on June 30 and December 31, beginning on December 31, 2021 (FV of $1. P of $1. EVA 0:51. PVA O $1. FVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds on June 30, 2021 2. Calculate the interest expense Singleton reports in 2021 for these bonds using the effective interest method, Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required: Required 2 Determine the price of the bonds on June 30, 2021. (Enter your answers in whole dollars. Round percentage answers to one decimal place. Round your final answers to nearest whole dollar amount) Table values are based on n 30 25% Cash Flow Amount Prosant Value Interest $ 4,000,000 $ 80,721,170 Principal 100,000,000 47,674,200 Prion of bonds 131,305,439 Required 2 > 1. 2. Calculate the interest expense Singleton reports in 2021 for these bonos us Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the interest expense Singleton reports in 2021 for these bonds using the effective interest method. (Enter you answers in whole dollars. Round your final answers to nearest whole dollar amount.) Period-End Cash Interest Pald Bond Interest Expense Premium Amortization Carrying Value 06/30/2021 $ 131,395,439 130,680,325 $ 4,000,000 12/31/2021 715,114 $ 3,284,886 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts