Question: please type your answer 4. Consider a portfolio consisting of 6 stocks and 10 put options on the stocks. The current stock price is So

please type your answer

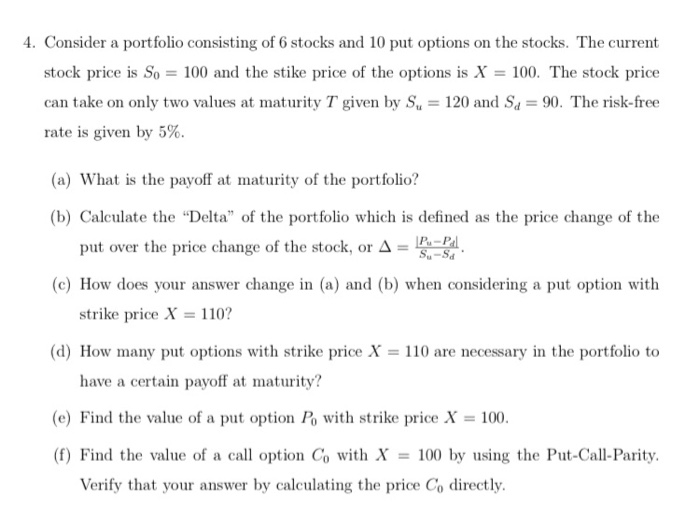

4. Consider a portfolio consisting of 6 stocks and 10 put options on the stocks. The current stock price is So = 100 and the stike price of the options is X = 100. The stock price can take on only two values at maturity T given by Su = 120 and Sd = 90. The risk-free rate is given by 5%. (a) What is the payoff at maturity of the portfolio? (b) Calculate the "Delta" of the portfolio which is defined as the price change of the put over the price change of the stock, or A = P.-PAL (c) How does your answer change in (a) and (b) when considering a put option with strike price X = 110? (d) How many put options with strike price X = 110 are necessary in the portfolio to have a certain payoff at maturity? (e) Find the value of a put option Po with strike price X = 100. (f) Find the value of a call option Co with X = 100 by using the Put-Call-Parity. Verify that your answer by calculating the price Co directly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts