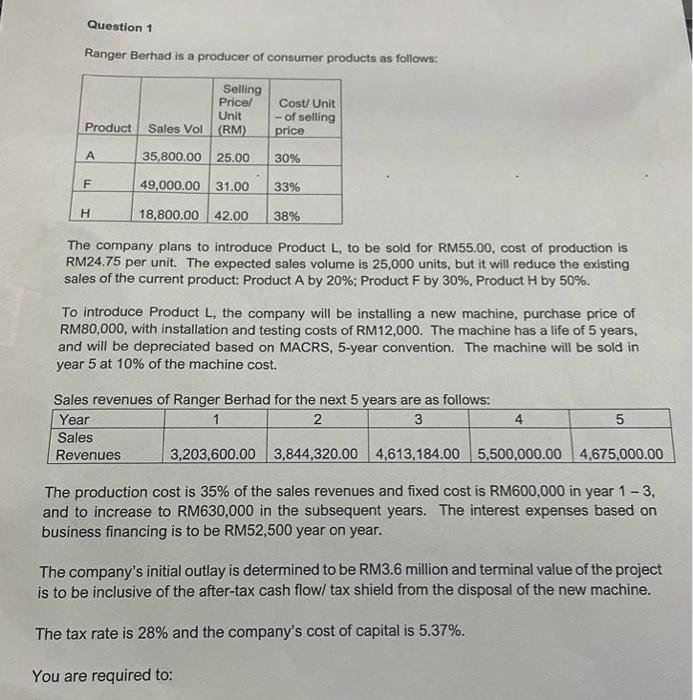

Question: please type your answers out , don't write on a paper with pen Ranger Berhad is a producer of consumer products as follows: The company

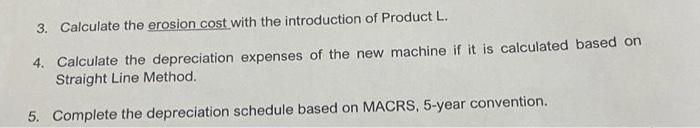

Ranger Berhad is a producer of consumer products as follows: The company plans to introduce Product L, to be sold for RM55.00, cost of production is RM24.75 per unit. The expected sales volume is 25,000 units, but it will reduce the existing sales of the current product: Product A by 20%; Product F by 30%. Product H by 50%. To introduce Product L, the company will be installing a new machine, purchase price of RM80,000, with installation and testing costs of RM12,000. The machine has a life of 5 years, and will be depreciated based on MACRS, 5 -year convention. The machine will be sold in year 5 at 10% of the machine cost. Sales revenues of Ranger Berhad for the next 5 years are as follows: The production cost is 35% of the sales revenues and fixed cost is RM600,000 in year 13, and to increase to RM630,000 in the subsequent years. The interest expenses based on business financing is to be RM52,500 year on year. The company's initial outlay is determined to be RM3.6 million and terminal value of the project is to be inclusive of the after-tax cash flow/ tax shield from the disposal of the new machine. The tax rate is 28% and the company's cost of capital is 5.37%. You are required to: 3. Calculate the erosion cost with the introduction of Product L. 4. Calculate the depreciation expenses of the new machine if it is calculated based on Straight Line Method. 5. Complete the depreciation schedule based on MACRS, 5-year convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts