Question: PLease upload a clear screenshot , or File , But please no mobile pictures of answers Q.3. Consider the following data for Fiscal year ending

PLease upload a clear screenshot , or File , But please no mobile pictures of answers

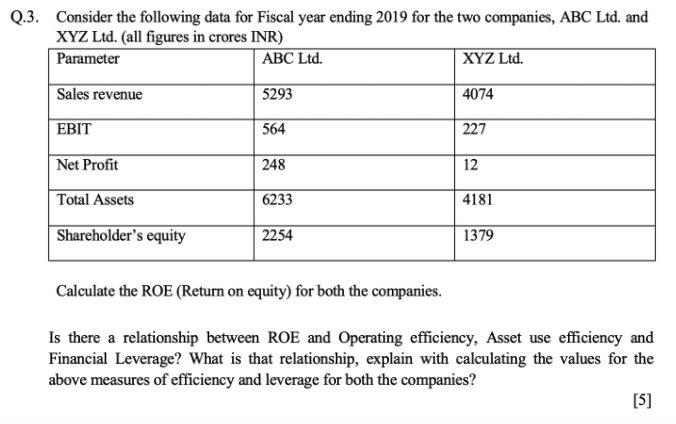

Q.3. Consider the following data for Fiscal year ending 2019 for the two companies, ABC Ltd. and XYZ Ltd. (all figures in crores INR) Parameter ABC Ltd. XYZ Ltd. Sales revenue 5293 4074 EBIT 564 227 Net Profit 248 12 Total Assets 6233 4181 Shareholder's equity 2254 1379 Calculate the ROE (Return on equity) for both the companies. Is there a relationship between ROE and Operating efficiency, Asset use efficiency and Financial Leverage? What is that relationship, explain with calculating the values for the above measures of efficiency and leverage for both the companies? [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts