Question: Please upload a copy of your work for this problem (LABEL as Solved 1) SMU is considering investing in a project that will generate the

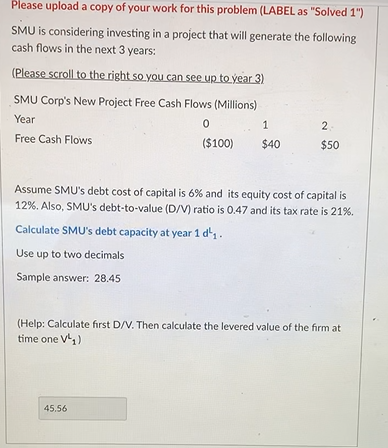

Please upload a copy of your work for this problem (LABEL as "Solved 1") SMU is considering investing in a project that will generate the following cash flows in the next 3 years: (Please scroll to the right so you can see up to year 3) SMU Corp's New Project Free Cash Flows (Millions) Year 0 1 2 Free Cash Flows ($100) $40 $50 Assume SMU's debt cost of capital is 6% and its equity cost of capital is 12%. Also, SMU's debt-to-value (D/V) ratio is 0.47 and its tax rate is 21%. Calculate SMU's debt capacity at year 1 d. Use up to two decimals Sample answer: 28.45 (Help: Calculate first D/V. Then calculate the levered value of the form at time one V) 45.56 Please upload a copy of your work for this problem (LABEL as "Solved 1") SMU is considering investing in a project that will generate the following cash flows in the next 3 years: (Please scroll to the right so you can see up to year 3) SMU Corp's New Project Free Cash Flows (Millions) Year 0 1 2 Free Cash Flows ($100) $40 $50 Assume SMU's debt cost of capital is 6% and its equity cost of capital is 12%. Also, SMU's debt-to-value (D/V) ratio is 0.47 and its tax rate is 21%. Calculate SMU's debt capacity at year 1 d. Use up to two decimals Sample answer: 28.45 (Help: Calculate first D/V. Then calculate the levered value of the form at time one V) 45.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts