Question: Please upload your calculations (e.g., an Excel spreadsheet, a Word document, a PDF file, or a picture of your work) for Q22. Make sure to

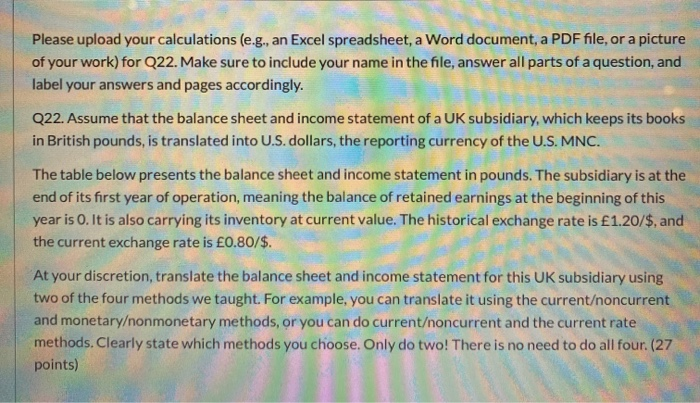

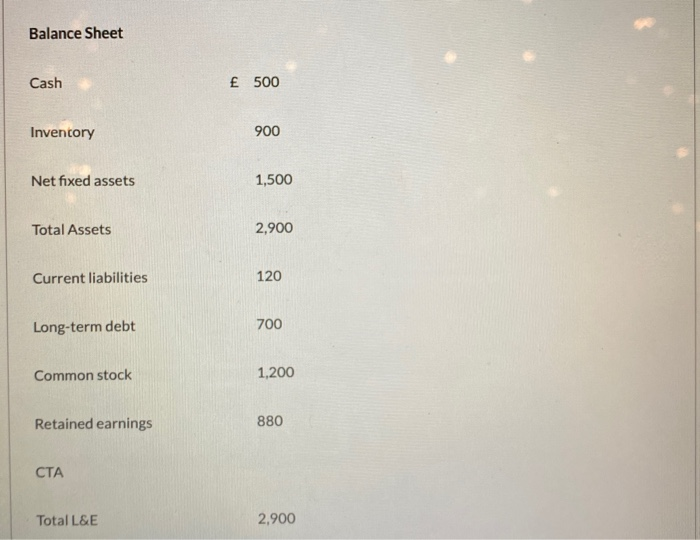

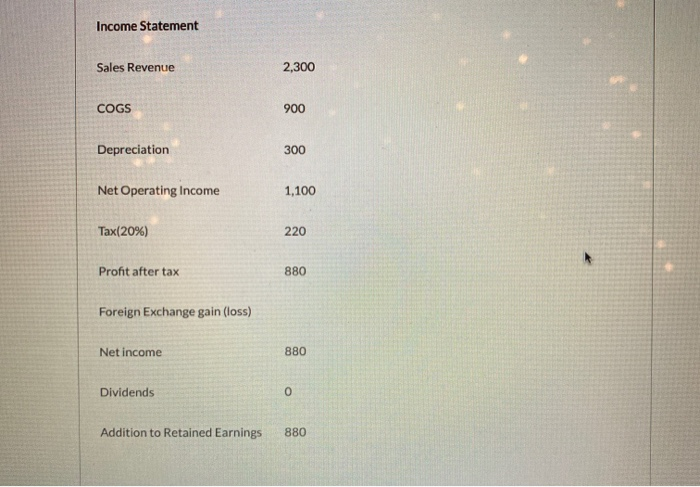

Please upload your calculations (e.g., an Excel spreadsheet, a Word document, a PDF file, or a picture of your work) for Q22. Make sure to include your name in the file, answer all parts of a question, and label your answers and pages accordingly. Q22. Assume that the balance sheet and income statement of a UK subsidiary, which keeps its books in British pounds, is translated into U.S. dollars, the reporting currency of the U.S. MNC. The table below presents the balance sheet and income statement in pounds. The subsidiary is at the end of its first year of operation, meaning the balance of retained earnings at the beginning of this year is 0. It is also carrying its inventory at current value. The historical exchange rate is 1.20/$, and the current exchange rate is 0.80/$. At your discretion, translate the balance sheet and income statement for this UK subsidiary using two of the four methods we taught. For example, you can translate it using the currentoncurrent and monetaryonmonetary methods, or you can do currentoncurrent and the current rate methods. Clearly state which methods you choose. Only do two! There is no need to do all four. (27 points) Balance Sheet Cash 500 Inventory 900 Net fixed assets 1,500 Total Assets 2,900 Current liabilities 120 Long-term debt 700 Common stock 1,200 Retained earnings 880 Total L&E 2,900 Income Statement Sales Revenue 2,300 COGS 900 Depreciation 300 Net Operating Income 1,100 Tax(20%) 220 Profit after tax 880 Foreign Exchange gain (loss) Net income 880 Dividends 0 Addition to Retained Earnings 880 Please upload your calculations (e.g., an Excel spreadsheet, a Word document, a PDF file, or a picture of your work) for Q22. Make sure to include your name in the file, answer all parts of a question, and label your answers and pages accordingly. Q22. Assume that the balance sheet and income statement of a UK subsidiary, which keeps its books in British pounds, is translated into U.S. dollars, the reporting currency of the U.S. MNC. The table below presents the balance sheet and income statement in pounds. The subsidiary is at the end of its first year of operation, meaning the balance of retained earnings at the beginning of this year is 0. It is also carrying its inventory at current value. The historical exchange rate is 1.20/$, and the current exchange rate is 0.80/$. At your discretion, translate the balance sheet and income statement for this UK subsidiary using two of the four methods we taught. For example, you can translate it using the currentoncurrent and monetaryonmonetary methods, or you can do currentoncurrent and the current rate methods. Clearly state which methods you choose. Only do two! There is no need to do all four. (27 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts