Question: Please Use 2020 Tax Forms Tax Return Problem 3 Margaret O'Hara has been divorced for about two years. She is 28 years old, and her

Please Use 2020 Tax Forms

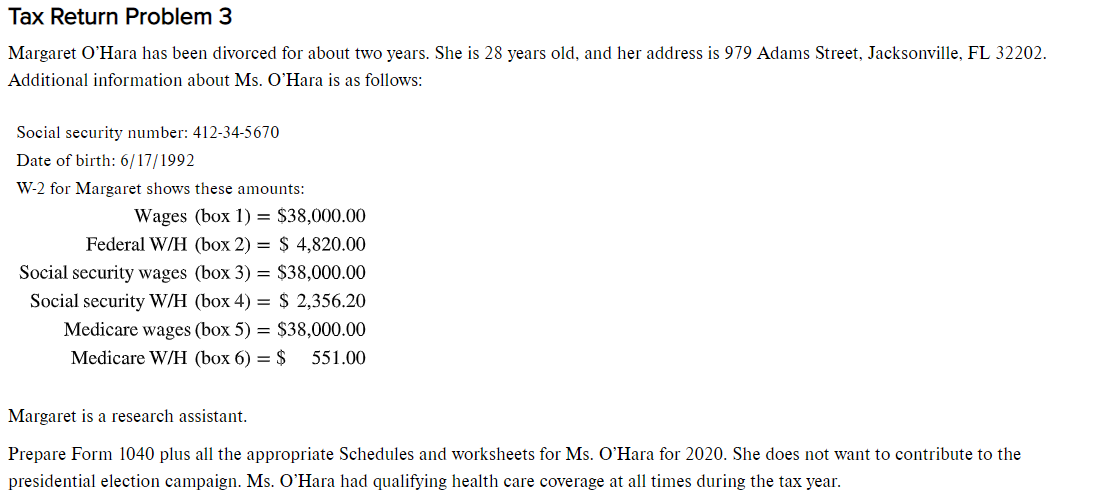

Tax Return Problem 3 Margaret O'Hara has been divorced for about two years. She is 28 years old, and her address is 979 Adams Street, Jacksonville, FL 32202. Additional information about Ms. O'Hara is as follows: Social security number: 412-34-5670 Date of birth: 6/17/1992 W-2 for Margaret shows these amounts: Wages (box 1) = $38,000.00 Federal W/H (box 2) = $ 4,820.00 Social security wages (box 3) = $38,000.00 Social security W/H (box 4) = $ 2,356.20 Medicare wages (box 5) = $38,000.00 Medicare W/H (box 6) = $ 551.00 Margaret is a research assistant. Prepare Form 1040 plus all the appropriate Schedules and worksheets for Ms. O'Hara for 2020. She does not want to contribute to the presidential election campaign. Ms. O'Hara had qualifying health care coverage at all times during the tax year. Tax Return Problem 3 Margaret O'Hara has been divorced for about two years. She is 28 years old, and her address is 979 Adams Street, Jacksonville, FL 32202. Additional information about Ms. O'Hara is as follows: Social security number: 412-34-5670 Date of birth: 6/17/1992 W-2 for Margaret shows these amounts: Wages (box 1) = $38,000.00 Federal W/H (box 2) = $ 4,820.00 Social security wages (box 3) = $38,000.00 Social security W/H (box 4) = $ 2,356.20 Medicare wages (box 5) = $38,000.00 Medicare W/H (box 6) = $ 551.00 Margaret is a research assistant. Prepare Form 1040 plus all the appropriate Schedules and worksheets for Ms. O'Hara for 2020. She does not want to contribute to the presidential election campaign. Ms. O'Hara had qualifying health care coverage at all times during the tax year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts