Question: Please use 2022 forms. TAX FORM/RETURN PREPARATION PROBLEMS Sally W. Emanual, a teacher, had the following dividends and interest during the current year: Additional information

Please use 2022 forms.

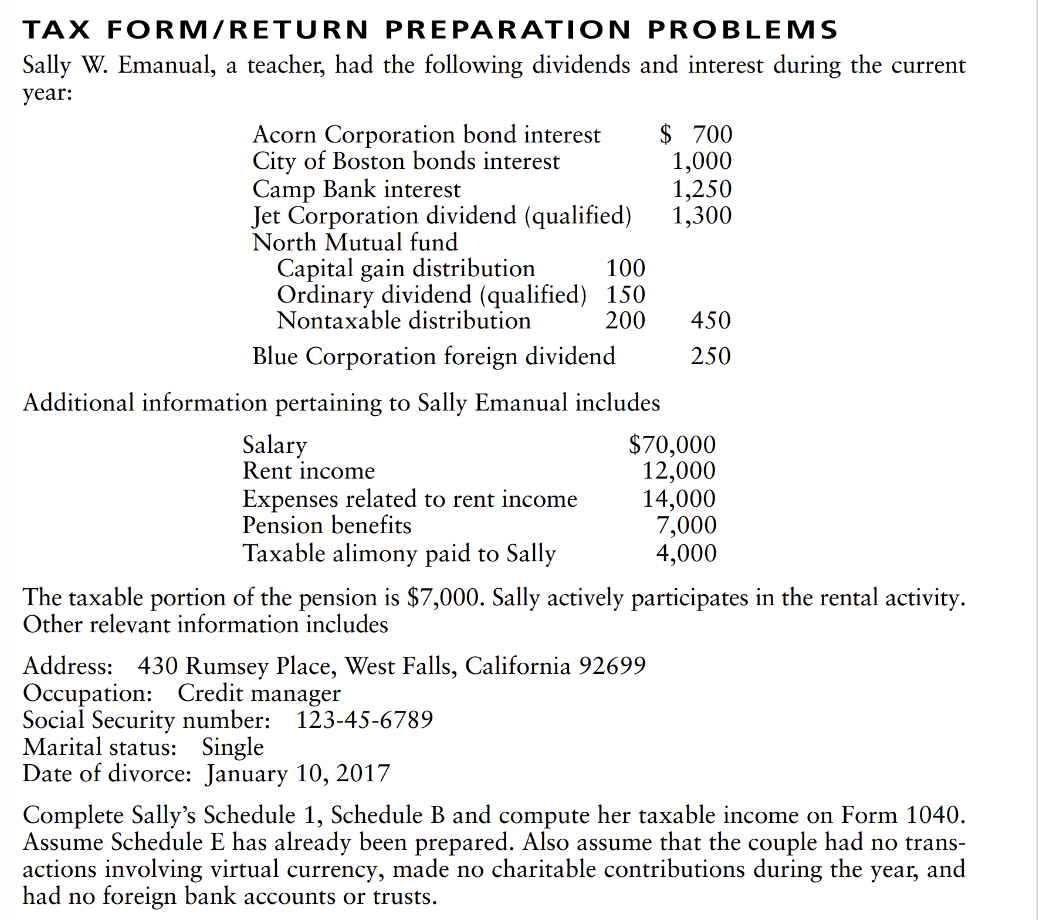

TAX FORM/RETURN PREPARATION PROBLEMS Sally W. Emanual, a teacher, had the following dividends and interest during the current year: Additional information pertaining to Sally Emanual includes The taxable portion of the pension is $7,000. Sally actively participates in the rental activity. Other relevant information includes Address: 430 Rumsey Place, West Falls, California 92699 Occupation: Credit manager Social Security number: 123456789 Marital status: Single Date of divorce: January 10, 2017 Complete Sally's Schedule 1, Schedule B and compute her taxable income on Form 1040. Assume Schedule E has already been prepared. Also assume that the couple had no transactions involving virtual currency, made no charitable contributions during the year, and had no foreign bank accounts or trusts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts