Question: please use a capital budgeting template like the one shown to explain your answer 3. International Soup Company is considering replacing a canning machine. The

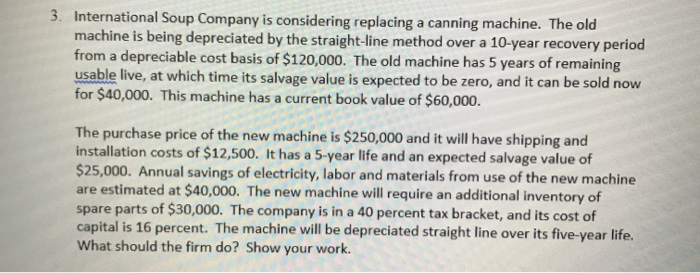

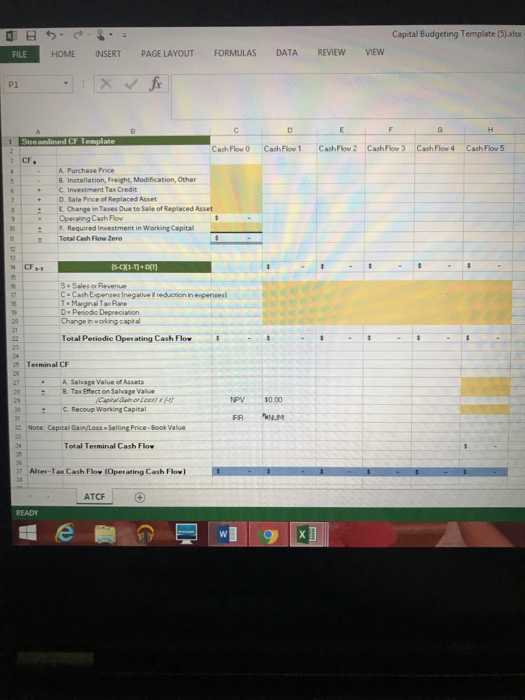

3. International Soup Company is considering replacing a canning machine. The old machine is being depreciated by the straight-line method over a 10-year recovery period from a depreciable cost basis of $120,000. The old machine has 5 years of remaining usable live, at which time its salvage value is expected to be zero, and it can be sold now for $40,000. This machine has a current book value of $60,000. The purchase price of the new machine is $250,000 and it will have shipping and installation costs of $12,500. It has a 5-year life and an expected salvage value of $25,000. Annual savings of electricity, labor and materials from use of the new machine are estimated at $40,000. The new machine will require an additional inventory of spare parts of $30,000. The company is in a 40 percent tax bracket, and its cost of capital is 16 percent. The machine will be depreciated straight line over its five-year life What should the firm do? Show your work. Capital Budgeting Template (5) FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Streamlined CF Template Cash Flow Cash Flow 1 Cash Flow 2 Cash Flow 3 Cash Flow 4 Cash Flow 5 A Purchase Price B. Installation, Freight Modification, Other Investment Tax Credit D. Sale Price of Replaced Asset E Change in Taxes Due to Sale of Replaced Asse Operwing Cash Flow F. Required investment in Working Capital Total Cash Flow Zero S-C1-) So wes or Revenue C Cash Expenses negative it reduction in spre To Marginal Tax Rule D- Periode Depreciation Change in working capital Total Periodic Operating Cash Flow - ESSEN A Salvape Value of Assets B. Tax Effect on Salvage Value Awal C Recoup Working Capital WUM Note: Capital Gairloss Selling Price - Book Value Total Terminal Cash Flow 37 Alter-Tau Cash Flow (Operating Cash Flow) ATCF READY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts