Question: please use a computer to write your answers or write your answers slowly and make your hand writing clear as much as possible , thankyou

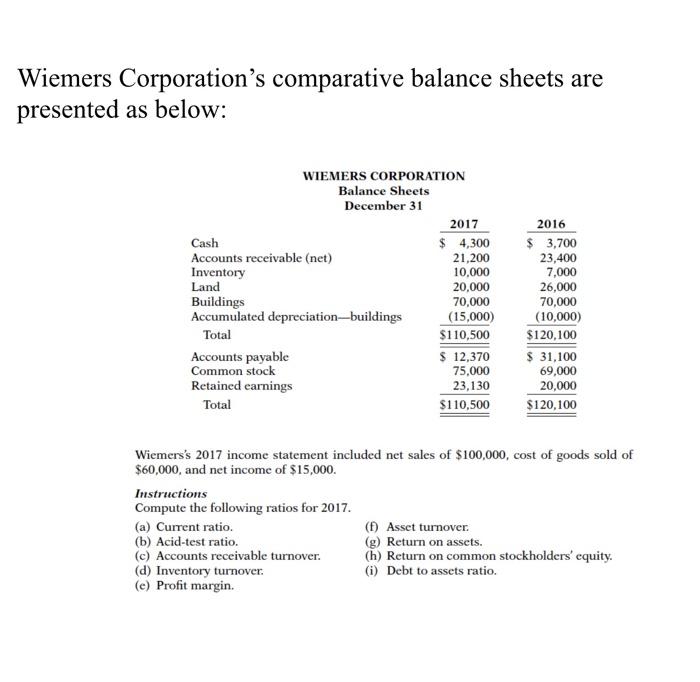

Wiemers Corporation's comparative balance sheets are presented as below: WIEMERS CORPORATION Balance Sheets December 31 2017 Cash $ 4,300 Accounts receivable (net) 21,200 Inventory 10,000 Land 20,000 Buildings 70,000 Accumulated depreciation--buildings (15,000) Total $110,500 Accounts payable $ 12,370 Common stock 75,000 Retained earnings 23,130 Total $110,500 2016 $ 3,700 23,400 7,000 26,000 70,000 (10,000) $120,100 $ 31,100 69,000 20,000 $120,100 Wiemers's 2017 income statement included net sales of $100,000, cost of goods sold of $60,000, and net income of $15,000. Instructions Compute the following ratios for 2017. (a) Current ratio. (1) Asset turnover. (b) Acid-test ratio. (g) Return on assets. (c) Accounts receivable turnover. (h) Return on common stockholders' equity. (d) Inventory turnover. (i) Debt to assets ratio. (e) Profit margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts