Question: Please use a table or excel. I'm lost, I want to be able to see the steps clearly. Thank you! 4. Spreads. (15 points) During

Please use a table or excel. I'm lost, I want to be able to see the steps clearly. Thank you!

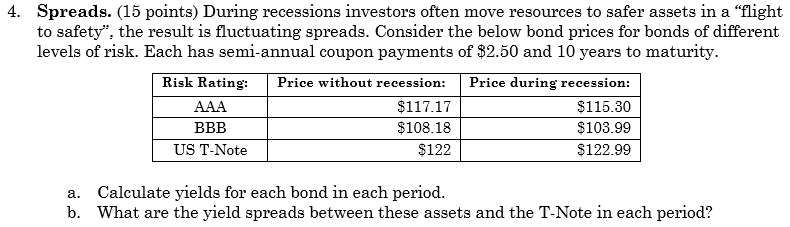

4. Spreads. (15 points) During recessions investors often move resources to safer assets in a "flight to safety", the result is fluctuating spreads. Consider the below bond prices for bonds of different levels of risk. Each has semi-annual coupon payments of $2.50 and 10 years to maturity. Risk Rating: Price without recession: Price during recession: AAA $117.17 $115.30 BBB $108.18 $103.99 US T-Note $122 $122.99 a. Calculate yields for each bond in each period. b. What are the yield spreads between these assets and the T-Note in each period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts