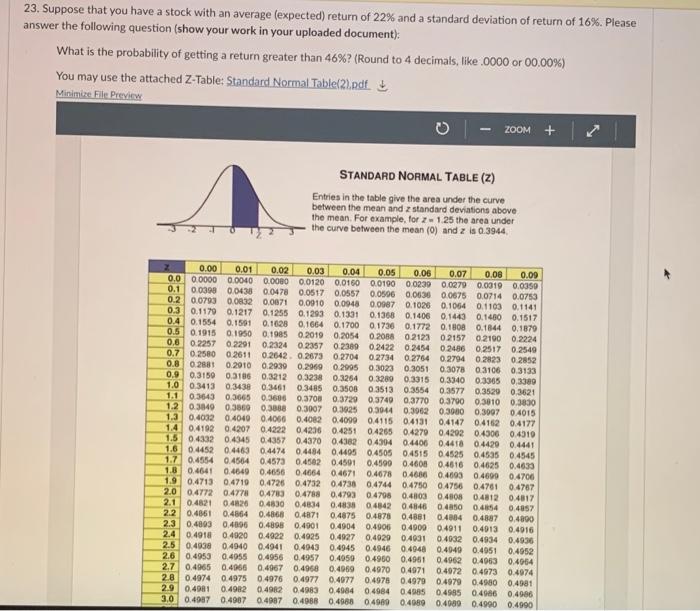

Question: please use attached z score table when solving 23. Suppose that you have a stock with an average (expected) return of 22% and a standard

23. Suppose that you have a stock with an average (expected) return of 22% and a standard deviation of return of 16%. Please answer the following question (show your work in your uploaded document) What is the probability of getting a return greater than 46%? (Round to 4 decimals, like .0000 or 00.00%) You may use the attached Z-Table: Standard NormalTable(21.pdf. Minimize File Preview ZOOM + STANDARD NORMAL TABLE (Z) Entries in the table give the area under the curve between the mean and standard deviations above the mean. For example, for z - 1.25 the area under the curve between the mean (0) and z is 0.3944 2 0.00 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.0 0.0000 0.0040 0.0080 0.0120 0.0160 0.0190 0.0239 0.0279 0.0019 0.0350 0.1 0.0398 0.0438 0.0478 0.0517 0.0557 0.0506 0.0636 0.0675 0.0714 0.0753 0.2 0.0793 0.0832 0.0071 0.0910 0.0048 0.0087 0.1028 0.1064 0.1103 0.1141 0.3 0.1179 0.1217 0.1255 0.1293 0.1331 0.1368 0.1406 0.1443 0.1460 0.1517 0.4 0.1554 0.1591 0.1628 0.1664 0.17000 1736 0.1772 0.1808 0.1844 0.1879 0.5 0.1915 0.1950 0.1985 0.2019 0.2054 0.2088 02123 02157 02190 0.2224 0.6 0.2257 02291 0.2324 0.2357 0.2389 0.2422 0.2454 02486 0,2517 0.2549 0.7 0.2580 0.2611 0.2642. 0.2673 0.2704 0.2734 0.2754 0.2794 0.2823 0.2852 0.8 0.2883 0.2010 0.2930 0.299 0.2995 0.3023 0.3051 0.3078 0.3106 0.3133 0.9 0.3159 0.3180 0.3212 0.3238 0.3264 0.3280 0.3315 0.3340 0.3365 0.3389 1.0 0.3413 0.3438 0.3461 0.3485 0.3508 0.3513 0.3554 0.3577 0.3529 0.3621 1.1 0.3643 0.3665 0.3600 0.3708 0.3729 0.3740 0,3770 0.3790 0.3810 0.3830 1.2 0.3849 0.3660 0.3888 0.3007 0.3925 0.3044 0.3962 03030 0.3097 0.4015 1.3 0.4032 0.4040 0.4056 0.4062 0.4099 0.4115 0.4131 0.4147 0.4162 0.4177 1.4 0.4192 0.4207 0.4222 0.4236 0.4251 0.4265 0.4270 0.4292 0.4300 0.4510 1.5 0.4332 0.4345 0.4357 0.4370 0.4382 04904 0.4406 0.4410 0.4420 0.4441 1.6 0.4452 0.4463 0.4474 0.4484 0.4495 0.4505 0.4515 0.4525 0.4535 0.4545 1.7 0.4554 0.4564 0.4573 0.4502 0.4501 0.45000.4608 0.4616 0.4625 0.4633 1.8 0.4641 0.4649 0.4656 0.4664 0.4671 0.4678 0.4666 0.4693 0.4690 0.4708 1.9 0.4713 0.4719 0.4726 0.4732 0.4738 0.4744 0.4750 0.4756 0.4761 0.4767 2.0 0.4772 0.4778 0.4783 0.4788 0.4793 0.4795 0.4803 0.4808 0.4812 0.4817 2.1 0.4821 0.4828 0.4830 0:48:34 0.4838 0.4842 0.4846 04850 0.4854 0.4057 2.2 0.4861 0.4864 0.4868 0.4871 0.4875 0.4878 0.4881 0.4004 0.4887 0.4000 2.3 0.4893 0.4096 0.4898 0.4901 0.4904 0.4906 0.4900 0.4911 0.4913 0.4916 2.4 0.4918 0.4920 0.4922 0.4925 0.4927 0.4929 0.4931 04932 0.4934 0.4936 2.5 0.4938 0.4040 0.4941 0.4943 0.4945 0.4946 0.4948 0.4049 0.4951 0.4952 2.6 0.4953 0.4056 0.4956 0.4957 0.4050 0.4960 0.4961 0.4962 0.4063 0.4954 2.7 0.4965 0.4056 0.4967 0.4958 0.4969 0.4970 0.4971 0.4072 0.4973 0.4974 2.8 0.4974 0.4975 0.49760.4977 0.4977 0.4978 0.4979 0.4979 0.4900 0.4981 2.9 0.4981 0.4982 0.4982 0.4983 0.4984 0.4984 0.4985 0.4985 0.4986 0.4986 3.0 0.4987 0.4967 0.4987 0.4988 0.496804980 0.40890.4000 0.4990 0.4990

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts