Question: Please use both tables below and provide a detailed description for your solutions. 2. Helen Morgan, CFA, has been asked to use the DDM to

Please use both tables below and provide a detailed description for your solutions.

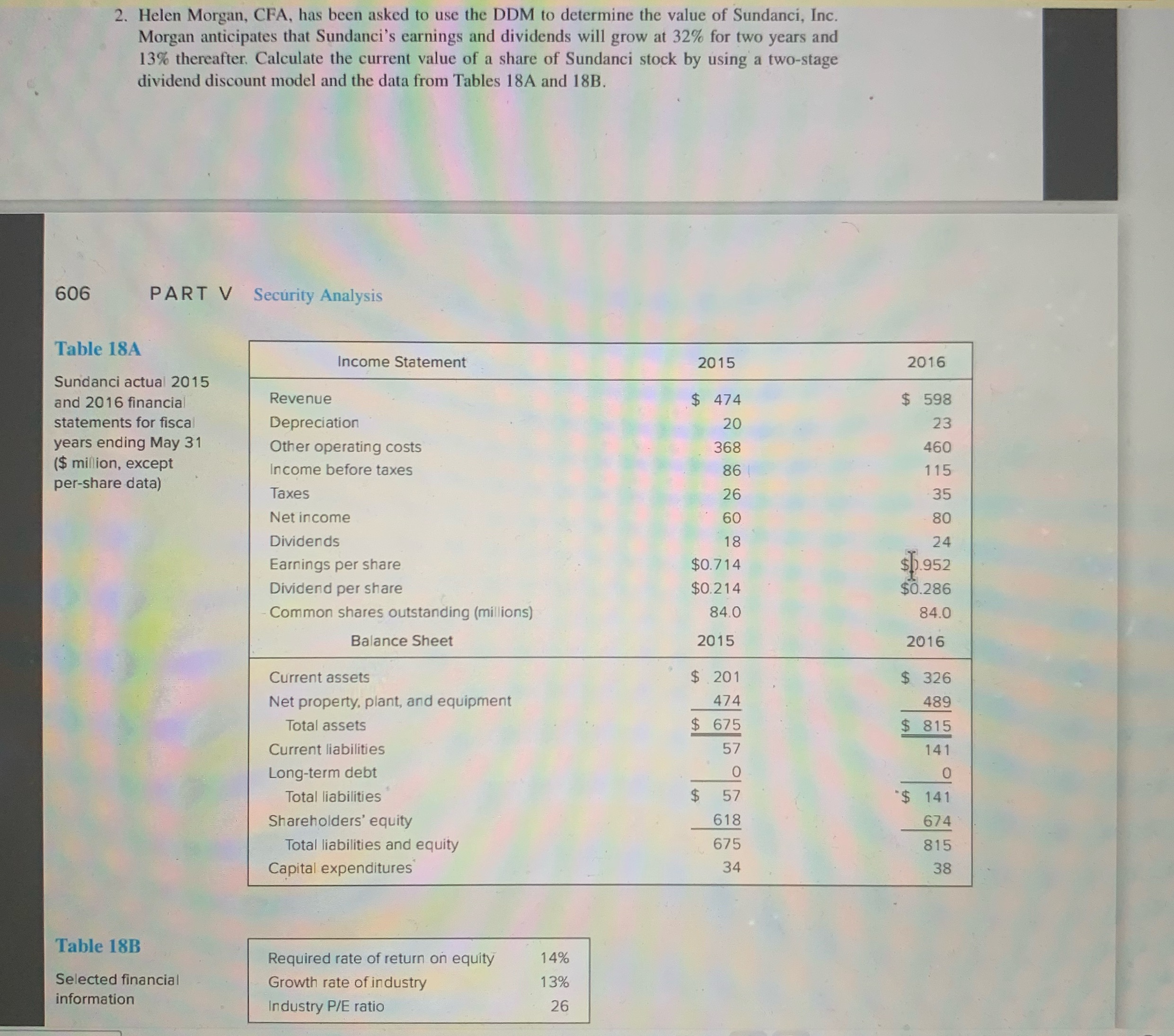

2. Helen Morgan, CFA, has been asked to use the DDM to determine the value of Sundanci, Inc. Morgan anticipates that Sundance's earnings and dividends will grow at 32% for two years and 13% thereafter. Calculate the current value of a share of Sundanci stock by using a two-stage dividend discount model and the data from Tables 18A and 18B. 606 PART V Security Analysis Table 18A Income Statement 2015 2016 Sundanci actual 2015 and 2016 financial Revenue $ 474 $ 598 statements for fisca Depreciation 20 23 years ending May 31 Other operating costs 368 460 ($ million, except Income before taxes 86 115 per-share data) Taxes 26 35 Net income 60 80 Dividends 18 24 Earnings per share $0.714 $1.952 Dividend per share $0.214 $0.286 Common shares outstanding (millions) 84.0 84.0 Balance Sheet 2015 2016 Current assets $ 201 $ 326 Net property, plant, and equipment 474 489 Total assets $ 675 $ 815 Current liabilities 57 141 Long-term debt 0 0 Total liabilities $ 57 5141 Shareholders' equity 618 574 Total liabilities and equity 675 815 Capital expenditures 34 38 Table 18B Required rate of return on equity 14% Selected financial Growth rate of industry 13% information Industry P/E ratio 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts