Question: please use c++ and #include . . marks) In tax-year 2020, Canada's income tax brackets are given as below: 15% on the first $48,585 of

please use c++ and #include

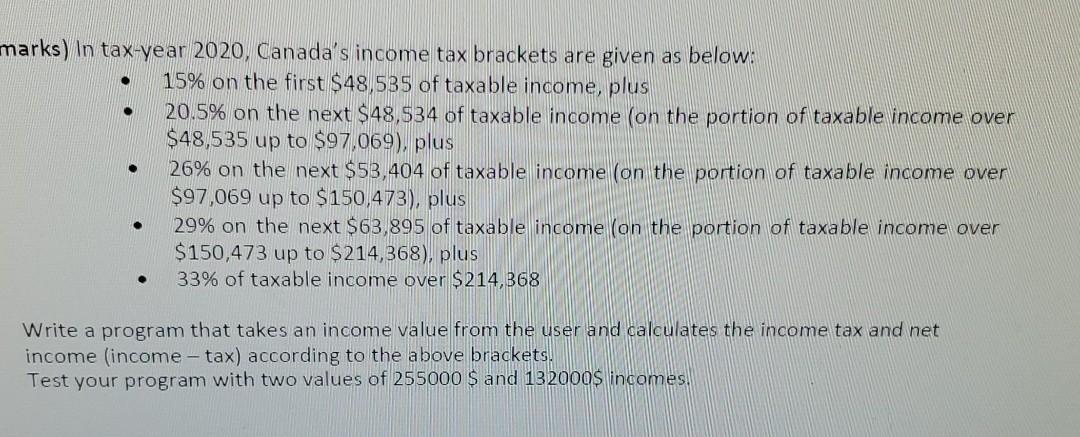

. . marks) In tax-year 2020, Canada's income tax brackets are given as below: 15% on the first $48,585 of taxable income, plus 20.5% on the next $48,534 of taxable income (on the portion of taxable income over $48,535 up to $97,069), plus 26% on the next $53,404 of taxable income (on the portion of taxable income over $97,069 up to $150,473), plus 29% on the next $63,895 of taxable income (on the portion of taxable income over $ 150,473 up to $214,368), plus 33% of taxable income over $214,368 . . Write a program that takes an income value from the user and calculates the income tax and net income (income-tax) according to the above brackets. Test your program with two values of 255000 $ and 132000$ incomes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts