Question: PLEASE USE CELL REFERENCES TO ANSWER QUESTIONS A B C D E G ROI and Residual Income JayCo Ltd. is considering expanding their Tennis Division

PLEASE USE CELL REFERENCES TO ANSWER QUESTIONS

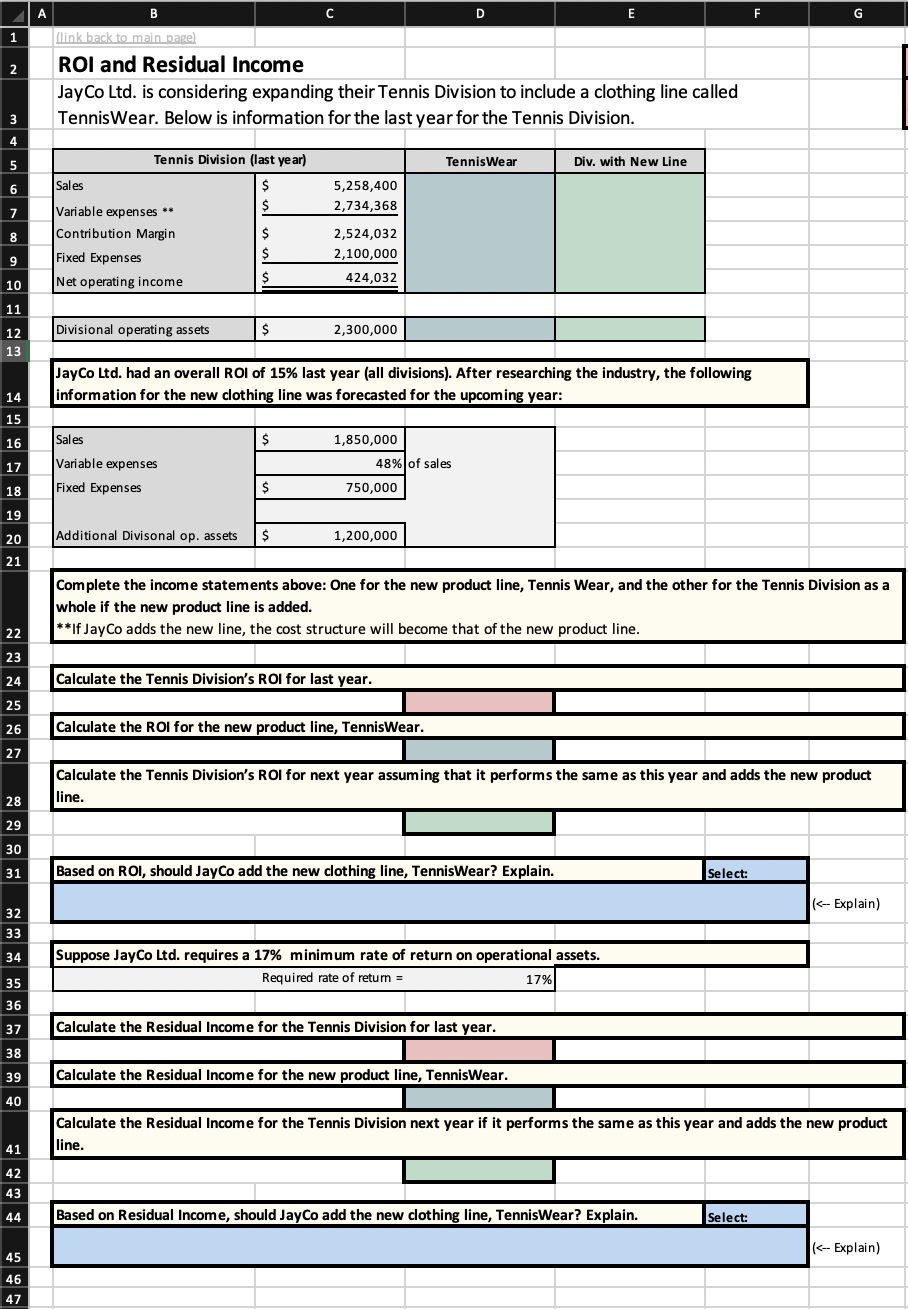

A B C D E G ROI and Residual Income JayCo Ltd. is considering expanding their Tennis Division to include a clothing line called TennisWear. Below is information for the last year for the Tennis Division. \begin{tabular}{|l|lr|r|r|} \hline \multicolumn{2}{|c|}{ Tennis Division (last year) } & TennisWear & Div. with New Line \\ \hline Sales & $ & 5,258,400 & & \\ Variable expenses ** & $ & 2,734,368 & & \\ Contribution Margin & $ & 2,524,032 & & \\ Fixed Expenses & $ & 2,100,000 & & \\ Net operating income & $ & 424,032 & & \\ \hline \end{tabular} JayCo Ltd. had an overall ROI of 15\% last year (all divisions). After researching the industry, the following information for the new clothing line was forecasted for the upcoming year: Complete the income statements above: One for the new product line, Tennis Wear, and the other for the Tennis Division as a whole if the new product line is added. **If JayCo adds the new line, the cost structure will become that of the new product line. Calculate the Tennis Division's ROl for last year. Calculate the ROI for the new product line, TennisWear. Calculate the Tennis Division's ROI for next year assuming that it performs the same as this year and adds the new line. Suppose JayCo Ltd. requires a 17% minimum rate of return on operational assets. Required rate of return =17% Calculate the Residual Income for the Tennis Division for last year. Calculate the Residual Income for the new product line, TennisWear. Calculate the Residual Income for the Tennis Division next year if it performs the same as this year and adds the new product line. Based on Residual Income, should JayCo add the new clothing line, TennisWear? Explain. Select: ( A B C D E G ROI and Residual Income JayCo Ltd. is considering expanding their Tennis Division to include a clothing line called TennisWear. Below is information for the last year for the Tennis Division. \begin{tabular}{|l|lr|r|r|} \hline \multicolumn{2}{|c|}{ Tennis Division (last year) } & TennisWear & Div. with New Line \\ \hline Sales & $ & 5,258,400 & & \\ Variable expenses ** & $ & 2,734,368 & & \\ Contribution Margin & $ & 2,524,032 & & \\ Fixed Expenses & $ & 2,100,000 & & \\ Net operating income & $ & 424,032 & & \\ \hline \end{tabular} JayCo Ltd. had an overall ROI of 15\% last year (all divisions). After researching the industry, the following information for the new clothing line was forecasted for the upcoming year: Complete the income statements above: One for the new product line, Tennis Wear, and the other for the Tennis Division as a whole if the new product line is added. **If JayCo adds the new line, the cost structure will become that of the new product line. Calculate the Tennis Division's ROl for last year. Calculate the ROI for the new product line, TennisWear. Calculate the Tennis Division's ROI for next year assuming that it performs the same as this year and adds the new line. Suppose JayCo Ltd. requires a 17% minimum rate of return on operational assets. Required rate of return =17% Calculate the Residual Income for the Tennis Division for last year. Calculate the Residual Income for the new product line, TennisWear. Calculate the Residual Income for the Tennis Division next year if it performs the same as this year and adds the new product line. Based on Residual Income, should JayCo add the new clothing line, TennisWear? Explain. Select: (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts