Question: please use chart 5.4 to answer some questions (when required) 1. What is meant by a currency trading at a discount or at a premium

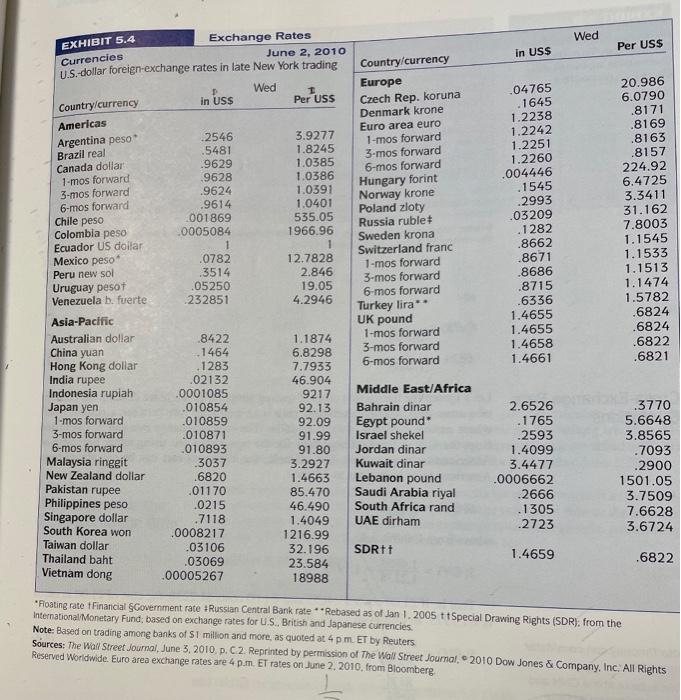

1. What is meant by a currency trading at a discount or at a premium in the forward market? 2. Over the past five years, the exchange rate between British pound and U.S. dollar, $/, has changed from about 1.90 to about 1.45. Would you agree that over this five-year period that British goods have become cheaper for buyers in the United States? 3. Using the American term quotes from Exhibit 5.4 in the book, calculate a cross-rate matrix for the euro, Swiss franc, Japanese yen, and the British pound so that the resulting triangular matrix is similar to the portion above the diagonal in Exhibit 5.6. 4. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the Canadian dollar versus the U.S. dollar using American term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results? 5. Doug Bernard specializes in cross-rate arbitrage. He notices the following quotes: Swiss franc/dollar =SFr1.5971/S Australian dollar/Swiss franc = A$1.1440/SFr Australian dollar/U.S. dollar = A$1.8215/$ Ignoring transaction costs, does Doug Bernard have an arbitrage opportunity based on these quotes? If there is an arbitrage opportunity, what steps would he take to make an arbitrage profit, and how would he profit if he has $1,000,000 available for this purpose. 6. The current spot exchange rate is $1.95/ and the three-month forward rate is $1.90/. Based on your analysis of the exchange rate, you are pretty confident that the spot exchange rate will be $1.92/ in three months. Assume that you would like to buy or sell 1,000,000. a. What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation? b. What would be your speculative profit in dollar terms if the spot exchange rate actually turns out to be $1.86/. Wed Per US$ EXHIBIT 5.4 Currencies in USS Exchange Rates June 2, 2010 U.S.-dollar foreign-exchange rates in late New York trading Country/currency Wed Europe 1 in USS Per USS Country/currency Czech Rep. koruna Denmark krone Americas Euro area euro 2546 3.9277 Argentina peso 1-mos forward Brazil real .5481 1.8245 3-mos forward Canada dollar 19629 1.0385 6-mos forward 1-mos forward .9628 1.0386 Hungary forint 3-mos forward .9624 1.0391 Norway Krone 6-mos forward .9614 1.0401 Poland zloty Chile peso 001869 535.05 Russia rublet Colombia peso .0005084 1966.96 Sweden krona Ecuador US dollar 1 1 Switzerland franc Mexico peso 0782 12.7828 1-mos forward Peru new sol 3514 2.846 3-mos forward Uruguay pesot 05250 19.05 Venezuela b. fuerte 6-mos forward 232851 4.2946 Turkey lira Asia-Pacific UK pound Australian dollar 8422 1.1874 1-mos forward China yuan .1464 6.8298 3-mos forward Hong Kong dollar .1283 7.7933 6-mos forward India rupee 02132 46.904 Indonesia rupiah .0001085 9217 Middle East Africa Japan yen .010854 92.13 Bahrain dinar 1-mos forward 010859 92.09 Egypt pound 3-mos forward 010871 91.99 Israel Shekel 6-mos forward .010893 91.80 Jordan dinar Malaysia ringgit .3037 3.2927 Kuwait dinar New Zealand dollar .6820 1.4663 Lebanon pound Pakistan rupee .01170 85.470 Saudi Arabia riyal Philippines peso 0215 46.490 South Africa rand Singapore dollar .7118 1.4049 UAE dirham South Korea won .0008217 Taiwan dollar 1216.99 .03106 32.196 Thailand baht SDRt 03069 Vietnam dong 23.584 .00005267 18988 .04765 .1645 1.2238 1.2242 1.2251 1.2260 .004446 .1545 .2993 _03209 .1282 .8662 .8671 .8686 .8715 .6336 1.4655 1.4655 1.4658 1.4661 20.986 6.0790 .8171 .8169 8163 .8157 224.92 6.4725 3.3411 31.162 7.8003 1.1545 1.1533 1.1513 1.1474 1.5782 .6824 .6824 .6822 .6821 2.6526 1765 2593 1.4099 3.4477 .0006662 2666 .1305 .2723 .3770 5.6648 3.8565 .7093 2900 1501.05 3.7509 7.6628 3.6724 1.4659 .6822 Floating rate Financial Government rate Russian Central Bank rate **Rebased as of Jan 1.2005 11 Special Drawing Rights (SDR), from the International Monetary Fund, based on exchange rates for U.S.. British and Japanese currencies. Note: Based on trading among banks of S1 million and more, as quoted at 4 pm ET by Reuters Sources: The Wall Street Journal, June 3, 2010, p. C 2. Reprinted by permission of The Wall Street Journal, 2010 Dow Jones & Company, Inc. All Rights Reserved Worldwide Euro area exchange rates are 4 p.m. Et rates on June 2, 2010, from Bloomberg

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts