Question: please use CPLEX and show a detailed answer 6.4 Exercise 6 J. C. Nickles receives credit card payments from four regions of the country (West,

please use CPLEX and show a detailed answer

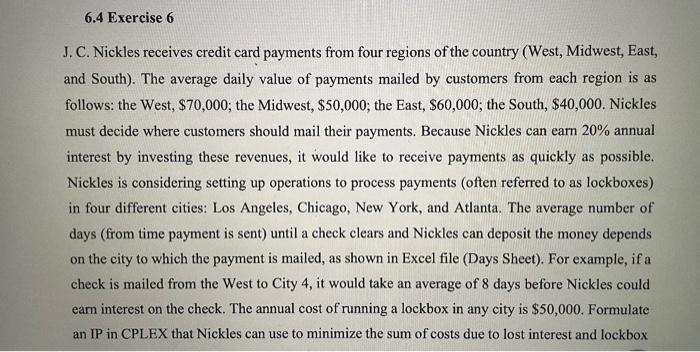

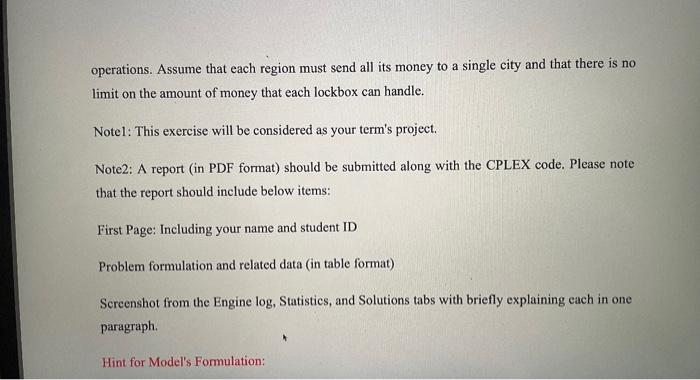

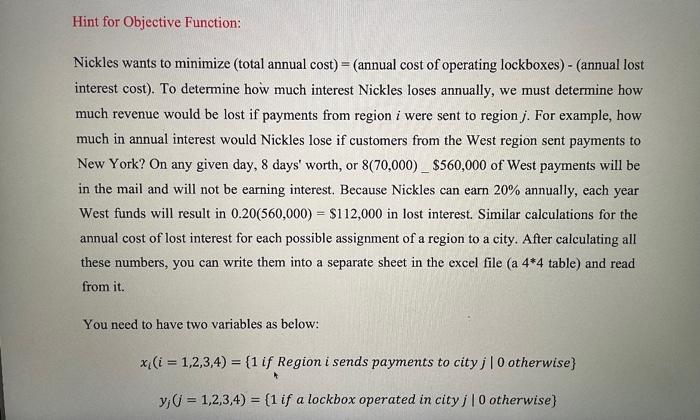

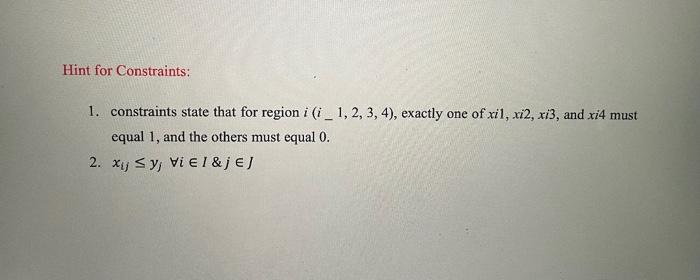

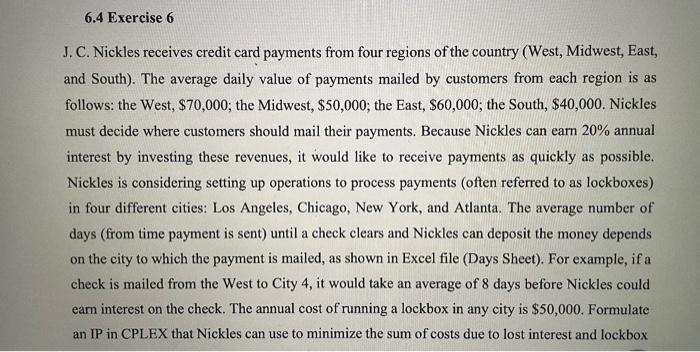

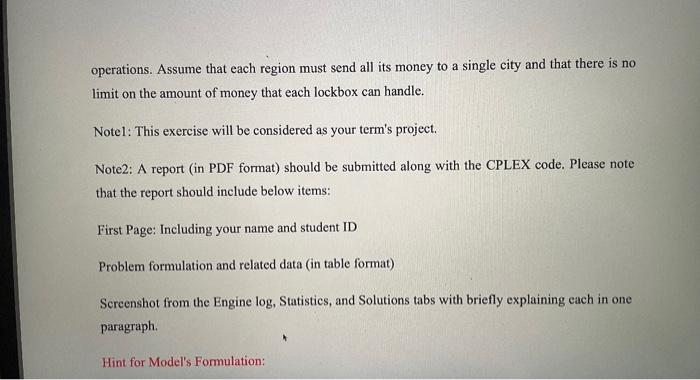

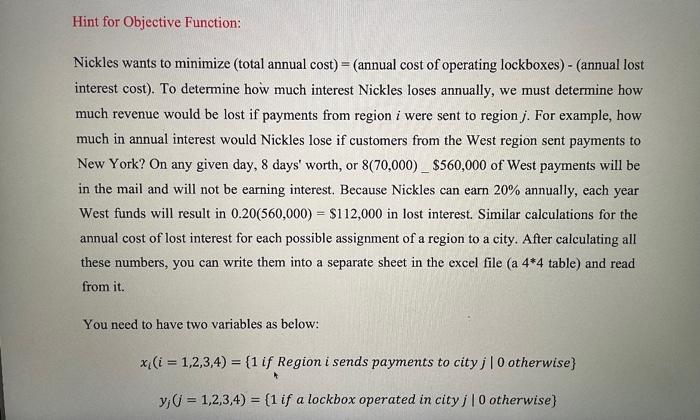

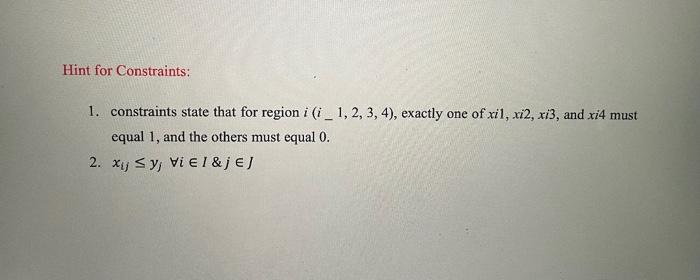

6.4 Exercise 6 J. C. Nickles receives credit card payments from four regions of the country (West, Midwest, East, and South). The average daily value of payments mailed by customers from each region is as follows: the West, $70,000; the Midwest, $50,000; the East, $60,000; the South, $40,000. Nickles must decide where customers should mail their payments. Because Nickles can earn 20% annual interest by investing these revenues, it would like to receive payments as quickly as possible. Nickles is considering setting up operations to process payments (often referred to as lockboxes) in four different cities: Los Angeles, Chicago, New York, and Atlanta. The average number of days (from time payment is sent) until a check clears and Nickles can deposit the money depends on the city to which the payment is mailed, as shown in Excel file (Days Sheet). For example, if a check is mailed from the West to City 4, it would take an average of 8 days before Nickles could earn interest on the check. The annual cost of running a lockbox in any city is $50,000. Formulate an IP in CPLEX that Nickles can use to minimize the sum of costs due to lost interest and lockbox operations. Assume that each region must send all its money to a single city and that there is no limit on the amount of money that each lockbox can handle. Notel: This exercise will be considered as your term's project. Note2: A report (in PDF format) should be submitted along with the CPLEX code. Please note that the report should include below items: First Page: Including your name and student ID Problem formulation and related data (in table format) Screenshot from the Engine log, Statistics, and Solutions tabs with briefly explaining cach in one paragraph Hint for Model's Formulation: Hint for Objective Function: Nickles wants to minimize (total annual cost) = (annual cost of operating lockboxes) - (annual lost interest cost). To determine how much interest Nickles loses annually, we must determine how much revenue would be lost if payments from region i were sent to region. For example, how much in annual interest would Nickles lose if customers from the West region sent payments to New York? On any given day, 8 days' worth, or 8(70,000)_$560,000 of West payments will be in the mail and will not be earning interest. Because Nickles can earn 20% annually, each year West funds will result in 0.20(560,000) = $112,000 in lost interest. Similar calculations for the annual cost of lost interest for each possible assignment of a region to a city. After calculating all these numbers, you can write them into a separate sheet in the excel file (a 4*4 table) and read from it. You need to have two variables as below: xi(i = 1,2,3,4) = {1 if Region i sends payments to city j | 0 otherwise} y; G = 1,2,3,4) = {1 if a lockbox operated in city j 0 otherwise) Hint for Constraints: 1. constraints state that for region i (i _ 1, 2, 3, 4), exactly one of xil, xi2, x3, and xi4 must equal 1, and the others must equal 0. 2. Xu Sy, Vi el&j EJ

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock