Question: please use exce to answer each question. thanks. Homework: NPV Excel Assignment Problem Save Score: 0 of 5 pts 1 of 1 (0 complete) HW

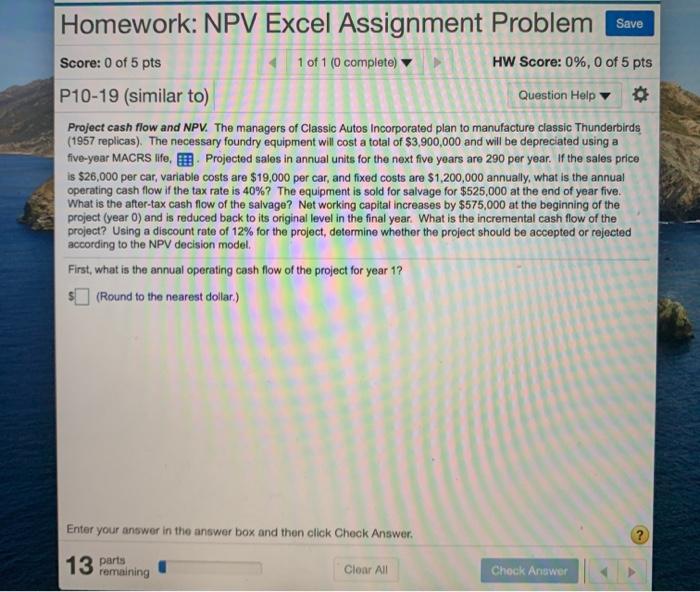

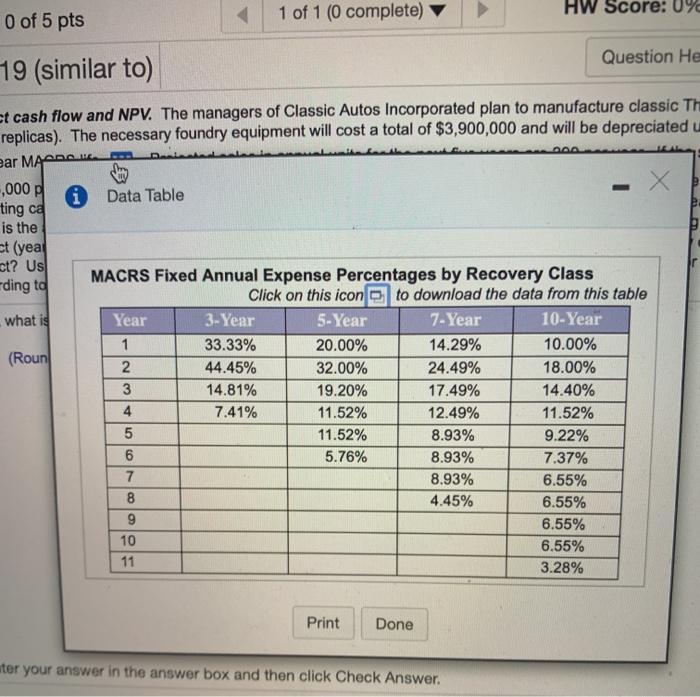

Homework: NPV Excel Assignment Problem Save Score: 0 of 5 pts 1 of 1 (0 complete) HW Score: 0%, 0 of 5 pts P10-19 (similar to) Question Help Project cash flow and NPV. The managers of Classic Autos Incorporated plan to manufacture classic Thunderbirds (1957 replicas). The necessary foundry equipment will cost a total of $3,900,000 and will be depreciated using a five-year MACRS life, Projected sales in annual units for the next five years are 290 per year. If the sales price is $26,000 per car, variable costs are $19,000 per car, and fixed costs are $1,200,000 annually, what is the annual operating cash flow if the tax rate is 40%? The equipment is sold for salvage for $525,000 at the end of year five. What is the after-tax cash flow of the salvage? Net working capital increases by $575,000 at the beginning of the project (year) and is reduced back to its original level in the final year. What is the incremental cash flow of the project? Using a discount rate of 12% for the project, determine whether the project should be accepted or rejected according to the NPV decision model. First, what is the annual operating cash flow of the project for year 1? (Round to the nearest dollar) Enter your answer in the answer box and then click Check Answer. ? 13 parts remaining Clear All Chock Answer - 1 of 1 (0 complete) HW Score: 0% 0 of 5 pts Question He 19 (similar to) et cash flow and NPV. The managers of Classic Autos Incorporated plan to manufacture classic Th replicas). The necessary foundry equipment will cost a total of $3,900,000 and will be depreciated ear MACDO sy -,000 X Data Table ting ca is the ct (yea ct? Us MACRS Fixed Annual Expense Percentages by Recovery Class ding to Click on this icon to download the data from this table what is Year 3-Year 5-Year 7-Year 10-Year 1 33.33% 20.00% 14.29% 10.00% (Roun 2 44.45% 32.00% 24.49% 18.00% 14.81% 19.20% 17.49% 14.40% 4 7.41% 11.52% 12.49% 11.52% 5 11.52% 8.93% 9.22% 6 5.76% 8.93% 7.37% 8.93% 6.55% 8 4.45% 6.55% 9 6.55% 10 6.55% 11 3.28% Print Done ater your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts