Question: Please use Excel! 2. A $750,000 loan is to be repaid over 8-years. The interest rate on the loan i4) = 6.5%. (a) Set up

Please use Excel!

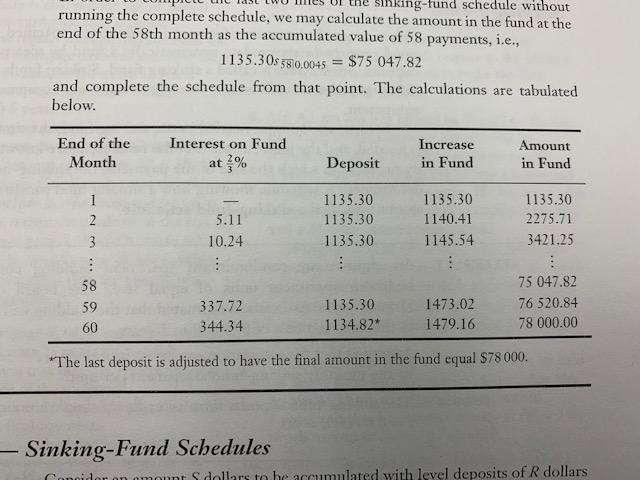

2. A $750,000 loan is to be repaid over 8-years. The interest rate on the loan i4) = 6.5%. (a) Set up a repayment schedule assuming the loan is amortized with quarterly payments over the 8 years. (3 marks) (b) Assume the loan is paid back using the sinking fund method and assume a sinking fund can earn (4) = 4.2%. Set up a sinking fund schedule similar to the one shown on page 186 of the textbook, but you also need to include a column for the quarterly expense and the book value. (3 marks) (c) Graph the outstanding balance of the amortized loan and the book value of the sinking fund loan on the same graph. (2 marks) ng-fund schedule without running the complete schedule, we may calculate the amount in the fund at the end of the 58th month as the accumulated value of 58 payments, i.e., 1135.30s 580.0045 = $75 047.82 and complete the schedule from that point. The calculations are tabulated below. End of the Month Interest on Fund at % Increase in Fund Deposit Amount in Fund 1 2 5.11 10.24 : 1135.30 1135.30 1135.30 1135.30 1140.41 1145.54 1135.30 2275.71 3421.25 : 58 59 60 337.72 344.34 1135.30 1134.82* 1473.02 1479.16 75 047.82 76 520.84 78 000.00 * The last deposit is adjusted to have the final amount in the fund equal $78 000. Sinking-Fund Schedules n amount dollars to he accumulated with level deposits of R dollars Con 2. A $750,000 loan is to be repaid over 8-years. The interest rate on the loan i4) = 6.5%. (a) Set up a repayment schedule assuming the loan is amortized with quarterly payments over the 8 years. (3 marks) (b) Assume the loan is paid back using the sinking fund method and assume a sinking fund can earn (4) = 4.2%. Set up a sinking fund schedule similar to the one shown on page 186 of the textbook, but you also need to include a column for the quarterly expense and the book value. (3 marks) (c) Graph the outstanding balance of the amortized loan and the book value of the sinking fund loan on the same graph. (2 marks) ng-fund schedule without running the complete schedule, we may calculate the amount in the fund at the end of the 58th month as the accumulated value of 58 payments, i.e., 1135.30s 580.0045 = $75 047.82 and complete the schedule from that point. The calculations are tabulated below. End of the Month Interest on Fund at % Increase in Fund Deposit Amount in Fund 1 2 5.11 10.24 : 1135.30 1135.30 1135.30 1135.30 1140.41 1145.54 1135.30 2275.71 3421.25 : 58 59 60 337.72 344.34 1135.30 1134.82* 1473.02 1479.16 75 047.82 76 520.84 78 000.00 * The last deposit is adjusted to have the final amount in the fund equal $78 000. Sinking-Fund Schedules n amount dollars to he accumulated with level deposits of R dollars Con

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts