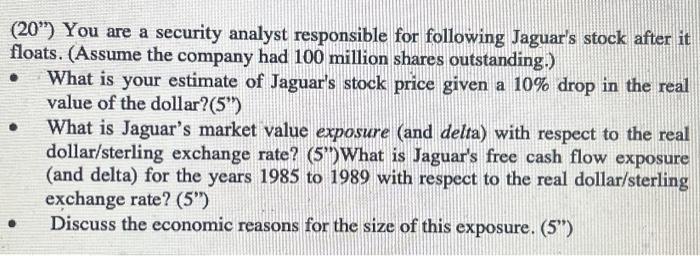

Question: Please Use Excel!!! (20) You are a security analyst responsible for following Jaguar's stock after it floats. (Assume the company had 100 million shares outstanding.)

(20") You are a security analyst responsible for following Jaguar's stock after it floats. (Assume the company had 100 million shares outstanding.) - What is your estimate of Jaguar's stock price given a 10% drop in the real value of the dollar?(5') - What is Jaguar's market value exposure (and delta) with respect to the real dollar/sterling exchange rate? (5') What is Jaguar's free cash flow exposure (and delta) for the years 1985 to 1989 with respect to the real dollar/sterling exchange rate? (5') Discuss the economic reasons for the size of this exposure. (5") (20") You are a security analyst responsible for following Jaguar's stock after it floats. (Assume the company had 100 million shares outstanding.) - What is your estimate of Jaguar's stock price given a 10% drop in the real value of the dollar?(5') - What is Jaguar's market value exposure (and delta) with respect to the real dollar/sterling exchange rate? (5') What is Jaguar's free cash flow exposure (and delta) for the years 1985 to 1989 with respect to the real dollar/sterling exchange rate? (5') Discuss the economic reasons for the size of this exposure. (5")

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts