Question: Please use Excel and if possible help show formulas. Thank you! PART 1 B-CAPITAL BUDGETING The same firm as in Part 1 is considering the

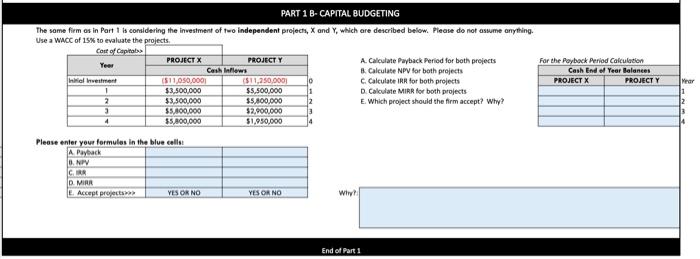

PART 1 B-CAPITAL BUDGETING The same firm as in Part 1 is considering the investment of two independent projects, X and Y, which are described below. Please do not assume anything. Use a WACC of 15% to evaluate the projects Cost of Capital PROJECT X PROJECT Y A. Calculate Payback period for both projects For the Payback Period Calculation Cash Inflews Calculate NPV for both projects Cash End of Year Balances hiriel vestment 1511,050,0001 ($11,250,000) C.Calculate for both projects PROJECT X PROJECT Y 1 $3,500,000 $5,500,000 D. Calculate MIRR for both projects 2 $3.500.000 $5.800.000 E. Which project should the firm accept? Why? 3 $5.000.000 $2.900.000 4 $5,800,000 $1.950,000 Yee Year 1 12 13 Please enter your formules in the blue calls A. Payback B. NIV D. MIRR L. Accept project YES OR NO YES OR NO Why! End of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts