Question: Please use excel and provide cell references with solutions 3) Dewey Cheetham & Howe Accounting firm is considering the purchase of a $1,000 New Haven

Please use excel and provide cell references with solutions

Please use excel and provide cell references with solutions

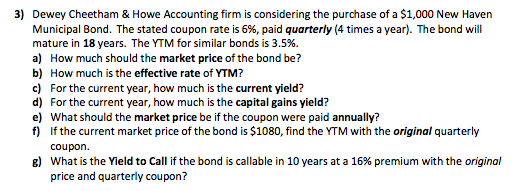

3) Dewey Cheetham \& Howe Accounting firm is considering the purchase of a $1,000 New Haven Municipal Bond. The stated coupon rate is 6%, paid quarterly ( 4 times a year). The bond will mature in 18 years. The YTM for similar bonds is 3.5%. a) How much should the market price of the bond be? b) How much is the effective rate of YTM? c) For the current year, how much is the current yield? d) For the current year, how much is the capital gains yield? e) What should the market price be if the coupon were paid annually? f) If the current market price of the bond is $1080, find the YTM with the original quarterly coupon. g) What is the Yield to Call if the bond is callable in 10 years at a 16% premium with the original price and quarterly coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts