Question: (Please Use Excel and show all the work and formulas) Stacy is interested in putting together a portfolio that is limited to only 2 securities

(Please Use Excel and show all the work and formulas)

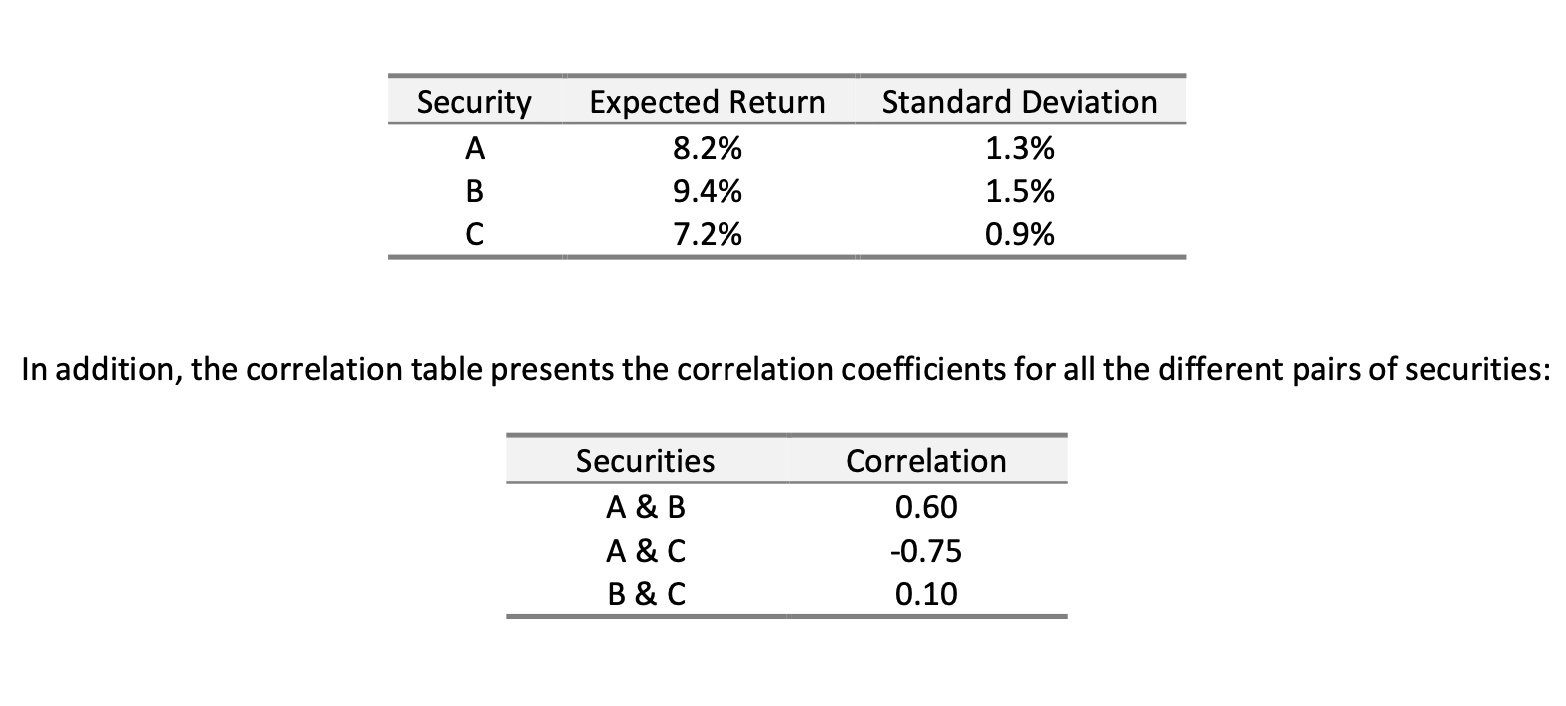

Stacy is interested in putting together a portfolio that is limited to only 2 securities (with an equal proportion of money invested in each). The following is the information of the 3 securities that Stacy is interested in:

-

Calculate the expected return for a portfolio containing (i) securities A and B, (ii) securities A and C, and (iii) securities B and C. Show your work.

-

Calculate the standard deviations for a portfolio containing (i) securities A and B, (ii) securities A and C, and (iii) securities B and C. Show your work.

-

Suppose Stacy's objective is to minimize her risk exposure. How should she change the compositions of the above three portfolios in order to meet her objective? Show your work. Hint: Calculate, using the appropriate formula, the proportions (weights) invested in the two assets in each portfolio that will meet her objective.

Security A B Expected Return 8.2% 9.4% 7.2% Standard Deviation 1.3% 1.5% 0.9% In addition, the correlation table presents the correlation coefficients for all the different pairs of securities: Securities A & B A&C B&C Correlation 0.60 -0.75 0.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts