Question: please use excel and show all workings. ty! 4. You are planning to work for the next 40 years (years 1 40) and expect to

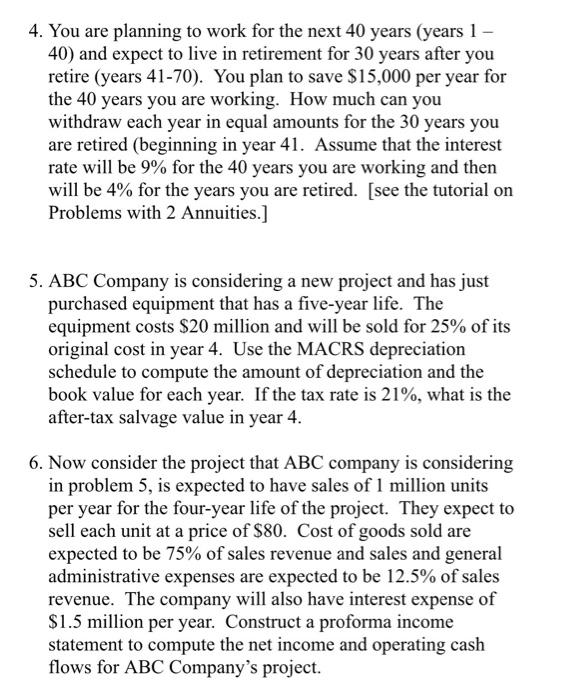

4. You are planning to work for the next 40 years (years 1 40) and expect to live in retirement for 30 years after you retire (years 41-70). You plan to save $15,000 per year for the 40 years you are working. How much can you withdraw each year in equal amounts for the 30 years you are retired (beginning in year 41. Assume that the interest rate will be 9% for the 40 years you are working and then will be 4% for the years you are retired. [see the tutorial on Problems with 2 Annuities.] 5. ABC Company is considering a new project and has just purchased equipment that has a five-year life. The equipment costs $20 million and will be sold for 25% of its original cost in year 4. Use the MACRS depreciation schedule to compute the amount of depreciation and the book value for each year. If the tax rate is 21%, what is the after-tax salvage value in year 4 . 6. Now consider the project that ABC company is considering in problem 5 , is expected to have sales of 1 million units per year for the four-year life of the project. They expect to sell each unit at a price of $80. Cost of goods sold are expected to be 75% of sales revenue and sales and general administrative expenses are expected to be 12.5% of sales revenue. The company will also have interest expense of $1.5 million per year. Construct a proforma income statement to compute the net income and operating cash flows for ABC Company's project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts