Question: Please, use Excel and show solutions step by step Hyrkas Corporation's most recent balance sheet and income statement appear below: Statement of Financial Position December

Please, use Excel and show solutions step by step

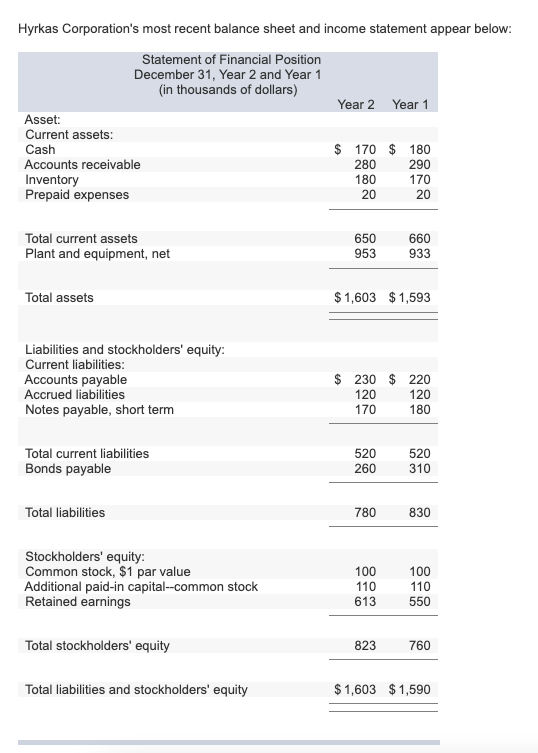

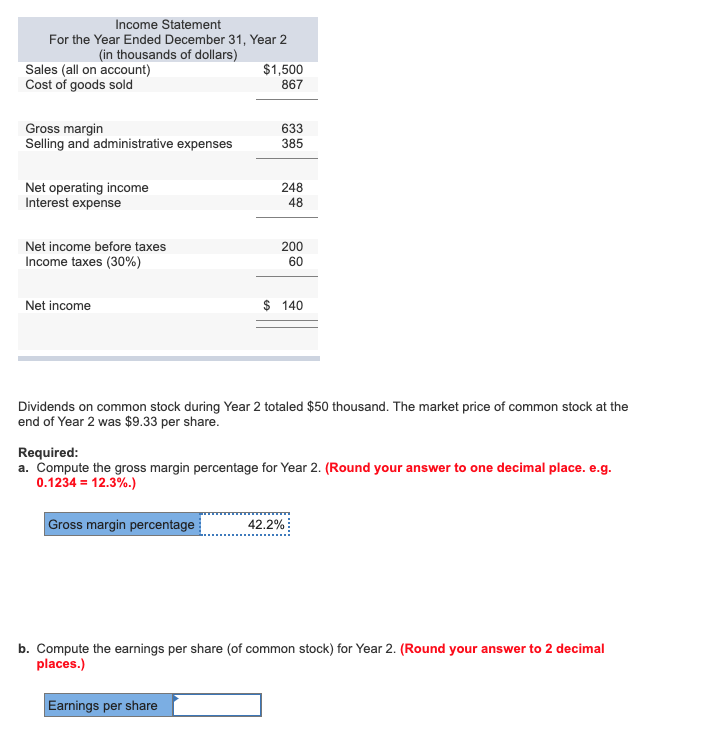

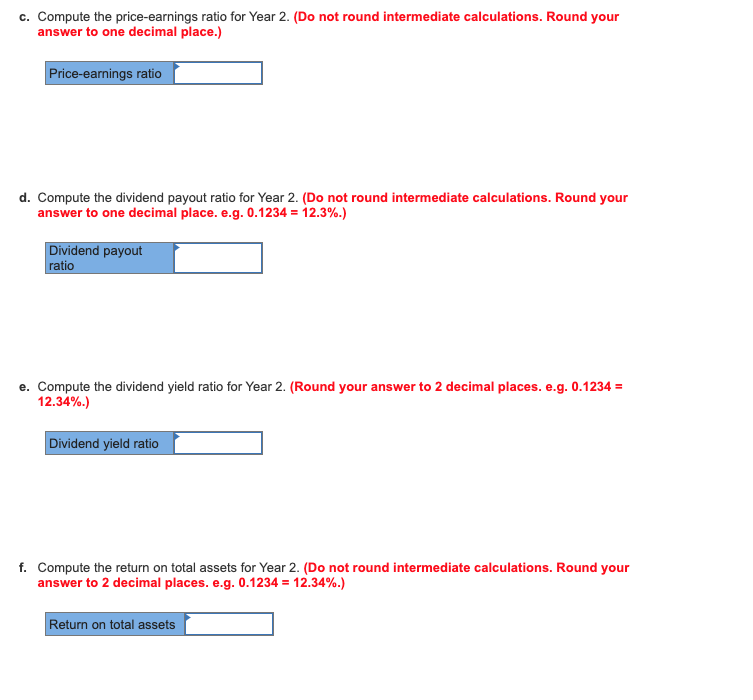

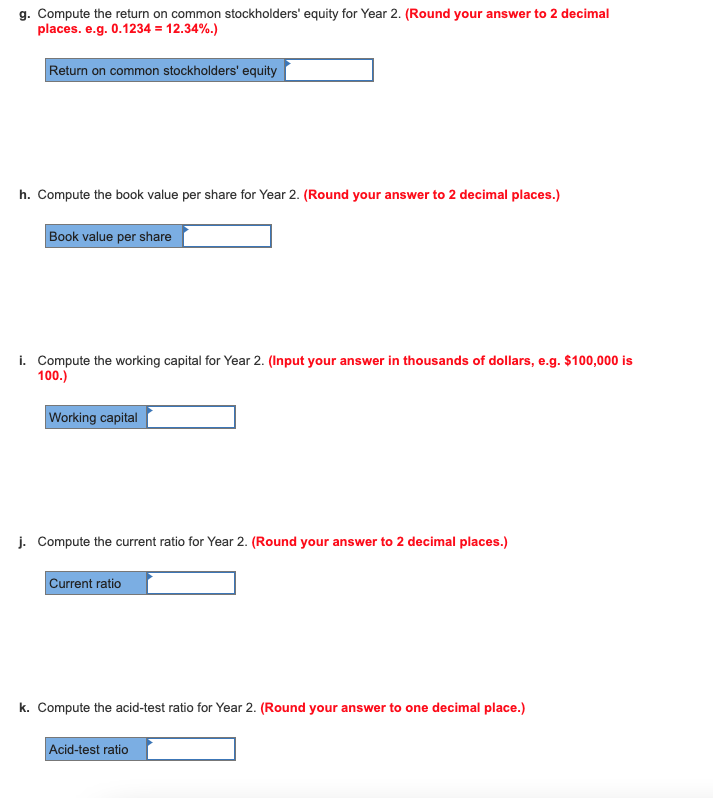

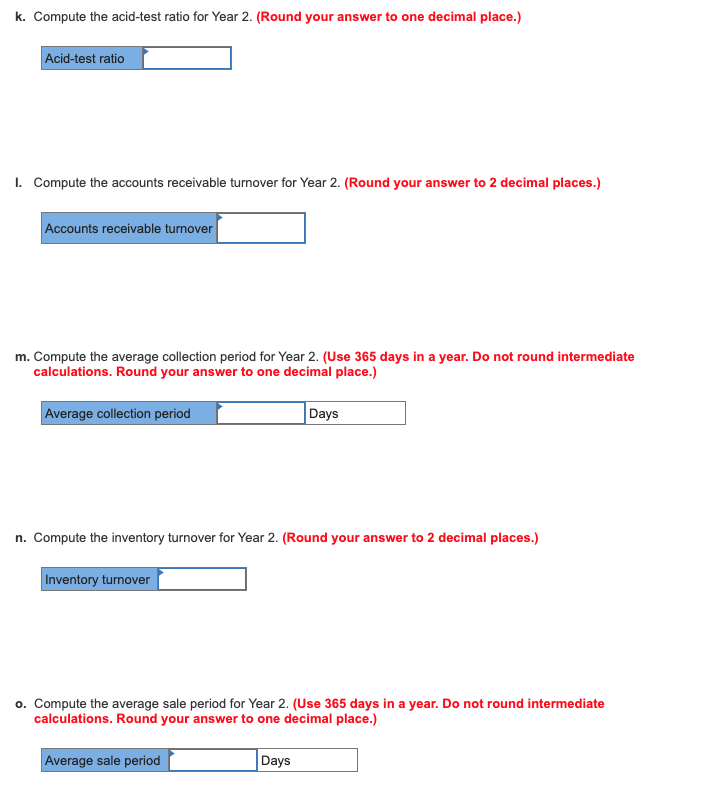

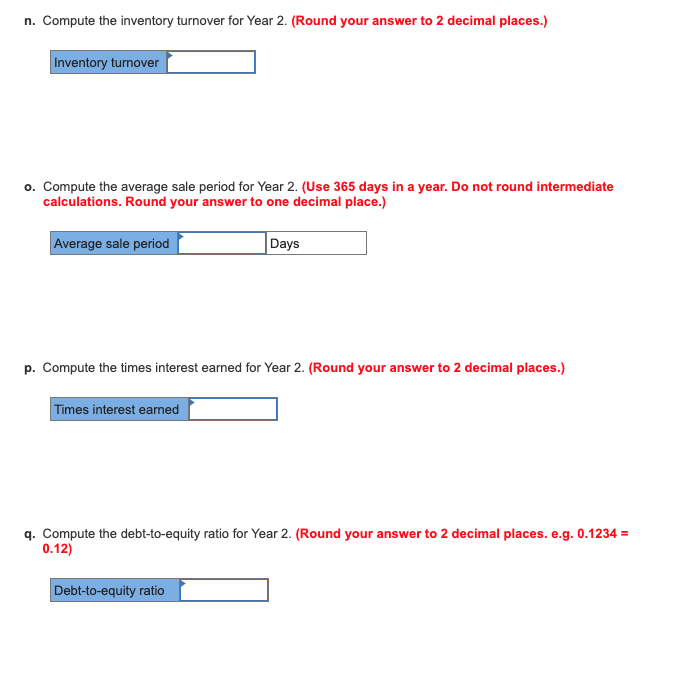

Hyrkas Corporation's most recent balance sheet and income statement appear below: Statement of Financial Position December 31, Year 2 and Year 1 (in thousands of dollars) Year 2 Year 1 Asset: Current assets: Cash Accounts receivable Inventory Prepaid expenses $ 170 $ 180 280 290 180 170 20 20 Total current assets Plant and equipment, net 650 953 660 933 Total assets $1,603 $1,593 Liabilities and stockholders' equity: Current liabilities: Accounts payable Accrued liabilities Notes payable, short term $ 230 $ 220 120 120 170 180 Total current liabilities Bonds payable 520 260 520 310 Total liabilities 780 830 Stockholders' equity: Common stock, $1 par value Additional paid-in capital--common stock Retained earnings 100 110 613 100 110 550 Total stockholders' equity 823 760 Total liabilities and stockholders' equity $1,603 $ 1,590 Income Statement For the Year Ended December 31, Year 2 (in thousands of dollars) Sales (all on account) $1,500 Cost of goods sold 867 Gross margin Selling and administrative expenses 633 385 Net operating income Interest expense 248 48 Net income before taxes Income taxes (30%) 200 60 Net income $ 140 Dividends on common stock during Year 2 totaled $50 thousand. The market price of common stock at the end of Year 2 was $9.33 per share. Required: a. Compute the gross margin percentage for Year 2. (Round your answer to one decimal place. e.g. 0.1234 = 12.3%.) Gross margin percentage 42.2% b. Compute the earnings per share of common stock) for Year 2. (Round your answer to 2 decimal places.) Earnings per share c. Compute the price-earnings ratio for Year 2. (Do not round intermediate calculations. Round your answer to one decimal place.) Price-earnings ratio d. Compute the dividend payout ratio for Year 2. (Do not round intermediate calculations. Round your answer to one decimal place. e.g. 0.1234 = 12.3%) Dividend payout ratio e. Compute the dividend yield ratio for Year 2. (Round your answer to 2 decimal places. e.g. 0.1234 = 12.34%.) Dividend yield ratio f. Compute the return on total assets for Year 2. (Do not round intermediate calculations. Round your answer to 2 decimal places. e.g. 0.1234 = 12.34%.) Return on total assets g. Compute the return on common stockholders' equity for Year 2. (Round your answer to 2 decimal places.e.g. 0.1234 = 12.34%.) Return on common stockholders' equity h. Compute the book value per share for Year 2. (Round your answer to 2 decimal places.) Book value per share i. Compute the working capital for Year 2. (Input your answer in thousands of dollars, e.g. $100,000 is 100.) Working capital j. Compute the current ratio for Year 2. (Round your answer to 2 decimal places.) Current ratio k. Compute the acid-test ratio for Year 2. (Round your answer to one decimal place.) Acid-test ratio k. Compute the acid-test ratio for Year 2. (Round your answer to one decimal place.) Acid-test ratio 1. Compute the accounts receivable turnover for Year 2. (Round your answer to 2 decimal places.) Accounts receivable turnover m. Compute the average collection period for Year 2. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to one decimal place.) Average collection period Days n. Compute the inventory turnover for Year 2. (Round your answer to 2 decimal places.) Inventory turnover o. Compute the average sale period for Year 2. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to one decimal place.) Average sale period Days n. Compute the inventory turnover for Year 2. (Round your answer to 2 decimal places.) Inventory turnover o. Compute the average sale period for Year 2. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to one decimal place.) Average sale period Days p. Compute the times interest earned for Year 2. (Round your answer to 2 decimal places.) Times interest earned q. Compute the debt-to-equity ratio for Year 2. (Round your answer to 2 decimal places. e.g. 0.1234 = 0.12) Debt-to-equity ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts