Question: Please use excel and show the functions needed to get the answer. Thanks A rapidly growing firm is currently paying a dividend of $1.25. The

Please use excel and show the functions needed to get the answer. Thanks

Please use excel and show the functions needed to get the answer. Thanks

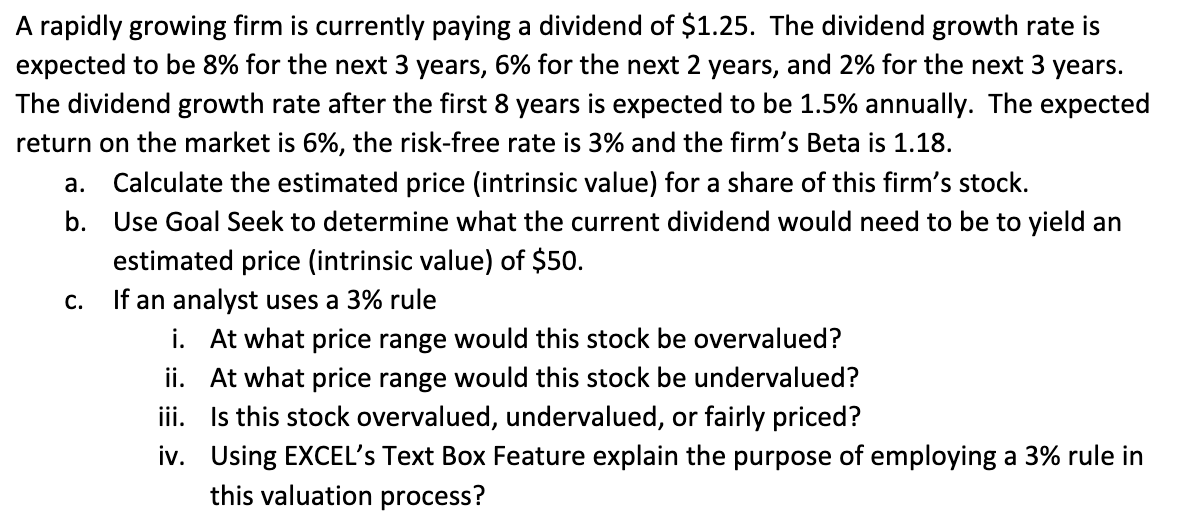

A rapidly growing firm is currently paying a dividend of $1.25. The dividend growth rate is expected to be 8% for the next 3 years, 6% for the next 2 years, and 2% for the next 3 years. The dividend growth rate after the first 8 years is expected to be 1.5% annually. The expected return on the market is 6%, the risk-free rate is 3% and the firm's Beta is 1.18. a. Calculate the estimated price (intrinsic value) for a share of this firm's stock. b. Use Goal Seek to determine what the current dividend would need to be to yield an estimated price (intrinsic value) of $50. c. If an analyst uses a 3% rule i. At what price range would this stock be overvalued? ii. At what price range would this stock be undervalued? iii. Is this stock overvalued, undervalued, or fairly priced? iv. Using EXCEL's Text Box Feature explain the purpose of employing a 3% rule in this valuation process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts