Question: PLEASE USE EXCEL!!! Certain new machinery when placed in service is estimated to cost $180,000. It is expected to reduce net annual operating expenses by

PLEASE USE EXCEL!!!

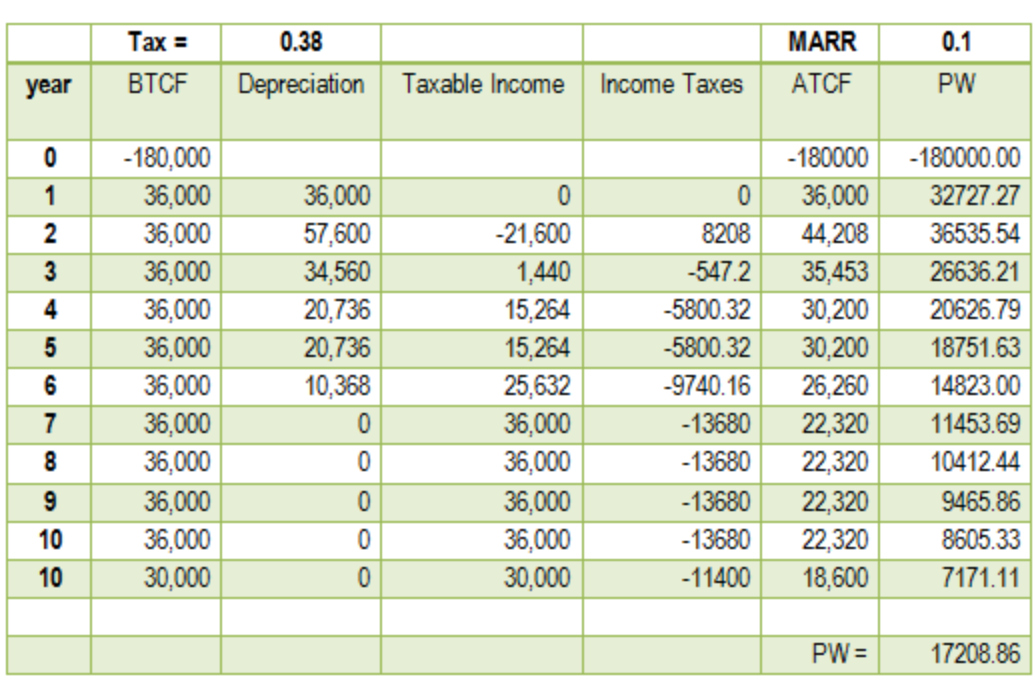

Certain new machinery when placed in service is estimated to cost $180,000. It is expected to reduce net annual operating expenses by $36,000 per year for 10 years and to have a $30,000 MV at the end of the 10th year. Develop the ATCF and BTCFs. Use the MACRS depreciation method, five years property class. The MARR is 10% and the tax rate is 38%.

1. Have available the Microsoft Excel software program.

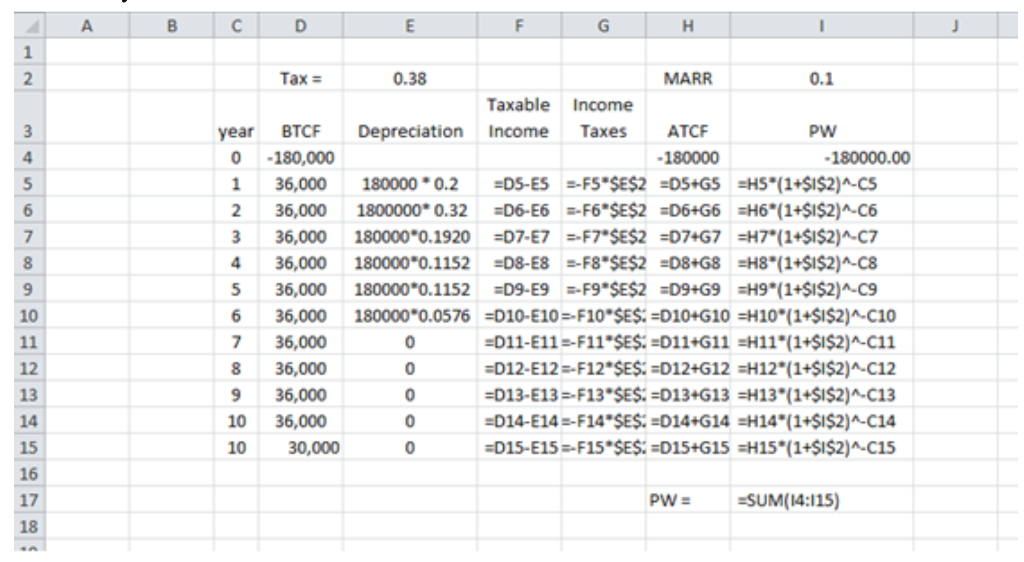

2. Construct a table in the Microsoft Excel work sheet as shown above. The instructions are shown in the second table.

3. The construction of the Microsoft Excel sheets and the answered questions has a total grading value of eight (8) points.

4. The deadline for hand in this exercise is indicated at the end of the week of the ninth module.

Steps:

- Start the Microsoft Excel software program.

- Use the example data to complete the assignment.

Notes:

Enter the information exactly as below.

Questions (You only have to write in Excel one of the answers, the one you think is the correct answer to the question)

1. When the MARR is changed from 10% to 20% the alternative is still economically acceptable?

- true

- false

2. When the MARR is changed from 10% to 5% the alternative is still economically acceptable?

- true

- false

3. In this example the depreciation charge helped to paid less taxes?

- true

- false

4. The higher the interest rate or MARR the less profitable is the alternative?

- true

- false

Tax = 0.38 0.1 MARR ATCF year BTCF Depreciation Taxable Income Income Taxes PW om -180,000 36,000 36.000 36,000 36,000 36,000 36,000 36,000 36,000 36,000 36,000 30,000 36,000 57,600 34,560 20,736 20,736 10,368 0 -21,600 1,440 15,264 15,264 25,632 36,000 36,000 36,000 36,000 30.000 0 8208 -547.2 -5800.32 -5800.32 -9740.16 -13680 -13680 -13680 -13680 - 11400 - 180000 36,000 44.208 35,453 30,200 30,200 26,260 22,320 22,320 22,320 22,320 18.600 -180000.00 32727.27 36535.54 26636.21 20626.79 18751.63 14823.00 11453.69 10412.44 9465.86 8605.33 7171.11 10 0 0 0 10 PW= 17208.86 A B C D E G H year 0 1 Tax = 0.38 MARR 0.1 Taxable income BTCF Depreciation Income Taxes ATCF PW -180,000 - 180000 - 180000.00 36,000 180000 0.2 =DS-ES --F5*$E$2 =D5+G5 =H5*(1+$1$2)^-CS 36,000 1800000*0.32 =D6-E6 --F6*$E$2 =D6+G6 =H6*(1+$1$2)^-C6 36,000 180000*0.1920 =D7-E7 =-F7"SE$2 =D74G7 =H7*(1+$1$2)^-C7 36,000 180000*0.1152 =D8-E8 --F8*$E$2 =D8+G8 =H8*(1+$1$2)^-C8 36,000 180000*0.1152 =D9-E9 D-F9 $E$2 =D9+G9 =H9*(1+$1$2)^-09 36,000 180000*0.0576 =D10-E10=-F10"$E$: =D10+G10 =H10"(1+$1$2)^-C10 36,000 =D11-E11-F11*$E$: =D11+G11 =H11*(1+$1$2)^-C11 36,000 0 =D12-E12-F12*$E$: =D12+G12 =H12*(1+$1$2)^-C12 36,000 0 =D13-E13 =-F13*$E$=D13+G13 =H13 (1+$I$2)^_C13 36,000 0 =D14-E14 --F14*$E$: =D14+G14 =H14*(1+$1$2)^-C14 30,0000 =D15-E15 --F15"$E$: =D15+G15 =H15*(1+$1$2)^-C15 6 8 10 10 PW = -SUM(14:115)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts