Question: Please use EXCEL for calculation and show the work clearly. Thank you Question 3. Consider a portfolio of Alibaba and Pepsi stock. Suppose an investor

Please use EXCEL for calculation and show the work clearly. Thank you

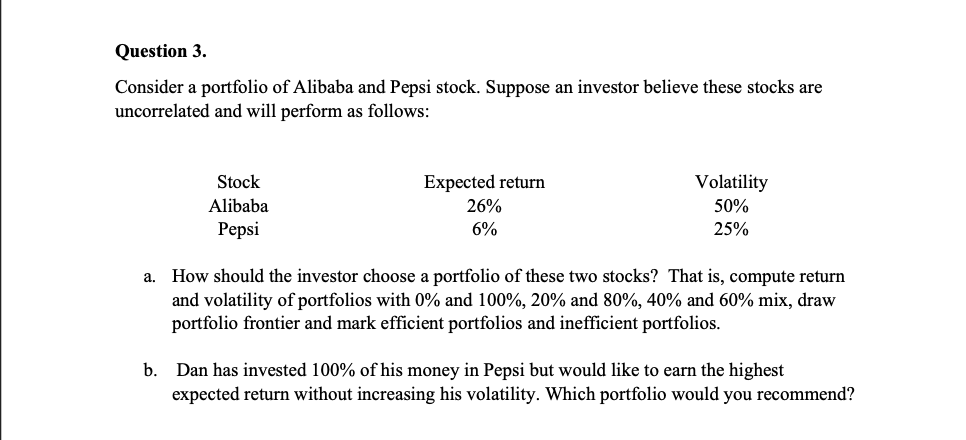

Question 3. Consider a portfolio of Alibaba and Pepsi stock. Suppose an investor believe these stocks are uncorrelated and will perform as follows: Stock Alibaba Pepsi Expected return 26% 6% Volatility 50% 25% a. How should the investor choose a portfolio of these two stocks? That is, compute return and volatility of portfolios with 0% and 100%, 20% and 80%, 40% and 60% mix, draw portfolio frontier and mark efficient portfolios and inefficient portfolios. b. Dan has invested 100% of his money in Pepsi but would like to earn the highest expected return without increasing his volatility. Which portfolio would you recommend? Question 3. Consider a portfolio of Alibaba and Pepsi stock. Suppose an investor believe these stocks are uncorrelated and will perform as follows: Stock Alibaba Pepsi Expected return 26% 6% Volatility 50% 25% a. How should the investor choose a portfolio of these two stocks? That is, compute return and volatility of portfolios with 0% and 100%, 20% and 80%, 40% and 60% mix, draw portfolio frontier and mark efficient portfolios and inefficient portfolios. b. Dan has invested 100% of his money in Pepsi but would like to earn the highest expected return without increasing his volatility. Which portfolio would you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts