Question: please use excel for this question and also provide the functions equations. any information to supplement my learning would be greatly help. thank you 1

please use excel for this question and also provide the functions equations. any information to supplement my learning would be greatly help. thank you

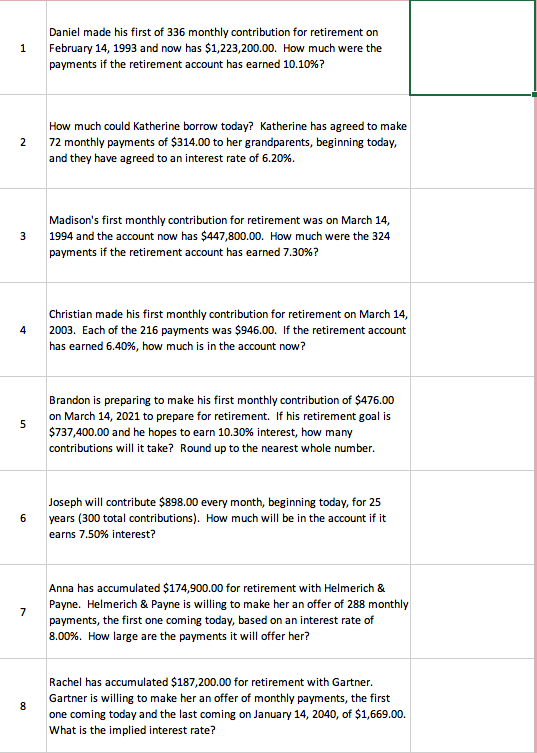

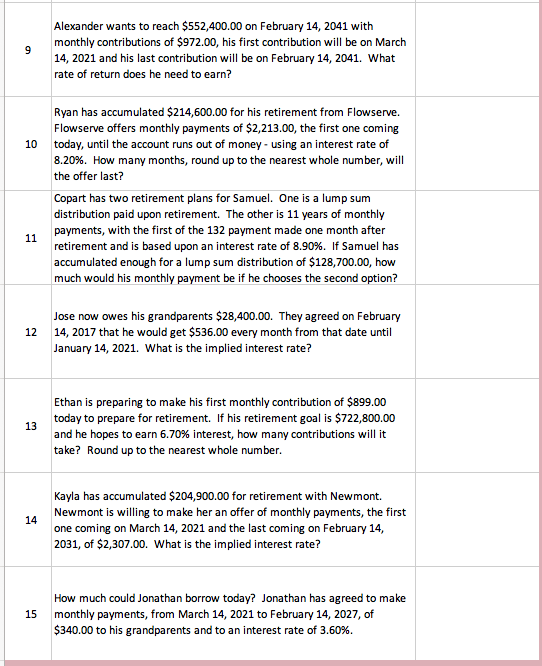

1 Daniel made his first of 336 monthly contribution for retirement on February 14, 1993 and now has $1,223,200.00. How much were the payments if the retirement account has earned 10.10%? 2 How much could Katherine borrow today? Katherine has agreed to make 72 monthly payments of $314.00 to her grandparents, beginning today, and they have agreed to an interest rate of 6.20%. 3 Madison's first monthly contribution for retirement was on March 14, 1994 and the account now has $447,800.00. How much were the 324 payments if the retirement account has earned 7.30%? 4 Christian made his first monthly contribution for retirement on March 14, 2003. Each of the 216 payments was $946.00. If the retirement account has earned 6.40%, how much is in the account now? 5 Brandon is preparing to make his first monthly contribution of $476.00 on March 14, 2021 to prepare for retirement. If his retirement goal is $737,400.00 and he hopes to earn 10.30% interest, how many contributions will it take? Round up to the nearest whole number. 6 Joseph will contribute $898.00 every month, beginning today, for 25 years (300 total contributions). How much will be in the account if it earns 7.50% interest? 7 Anna has accumulated $174,900.00 for retirement with Helmerich & Payne. Helmerich & Payne is willing to make her an offer of 288 monthly payments, the first one coming today, based on an interest rate of 8.00%. How large are the payments it will offer her? 8 Rachel has accumulated $187,200.00 for retirement with Gartner. Gartner is willing to make her an offer of monthly payments, the first one coming today and the last coming on January 14, 2040, of $1,669.00. What is the implied interest rate? 9 Alexander wants to reach $552,400.00 on February 14, 2041 with monthly contributions of $972.00, his first contribution will be on March 14, 2021 and his last contribution will be on February 14, 2041. What rate of return does he need to earn? 10 Ryan has accumulated $214,600.00 for his retirement from Flowserve. Flowserve offers monthly payments of $2,213.00, the first one coming today, until the account runs out of money - using an interest rate of 8.20%. How many months, round up to the nearest whole number, will the offer last? Copart has two retirement plans for Samuel. One is a lump sum distribution paid upon retirement. The other is 11 years of monthly payments, with the first of the 132 payment made one month after retirement and is based upon an interest rate of 8.90%. If Samuel has accumulated enough for a lump sum distribution of $128,700.00, how much would his monthly payment be if he chooses the second option? 11 12 Jose now owes his grandparents $28,400.00. They agreed on February 14, 2017 that he would get $536.00 every month from that date until January 14, 2021. What is the implied interest rate? 13 Ethan is preparing to make his first monthly contribution of $899.00 today to prepare for retirement. If his retirement goal is $722,800.00 and he hopes to earn 6.70% interest, how many contributions will it take? Round up to the nearest whole number. 14 Kayla has accumulated $204,900.00 for retirement with Newmont. Newmont is willing to make her an offer of monthly payments, the first one coming on March 14, 2021 and the last coming on February 14, 2031, of $2,307.00. What is the implied interest rate? 15 How much could Jonathan borrow today? Jonathan has agreed to make monthly payments, from March 14, 2021 to February 14, 2027, of $340.00 to his grandparents and to an interest rate of 3.60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts