Question: Please use Excel for this question :) Fred, who retired early at 58 from a multi-national is considering buying a small business. He is evaluating

Please use Excel for this question :)

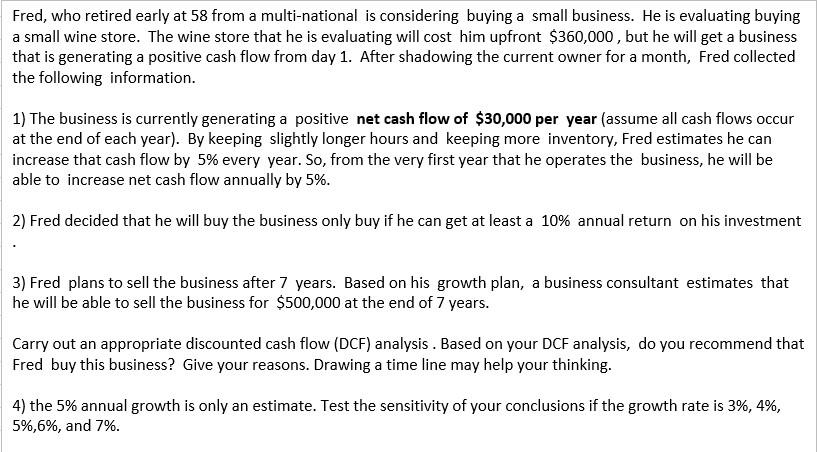

Fred, who retired early at 58 from a multi-national is considering buying a small business. He is evaluating buying a small wine store. The wine store that he is evaluating will cost him upfront $360,000, but he will get a business that is generating a positive cash flow from day 1. After shadowing the current owner for a month, Fred collected the following information. 1) The business is currently generating a positive net cash flow of $30,000 per year (assume all cash flows occur at the end of each year). By keeping slightly longer hours and keeping more inventory, Fred estimates he can increase that cash flow by 5% every year. So, from the very first year that he operates the business, he will be able to increase net cash flow annually by 5%. 2) Fred decided that he will buy the business only buy if he can get at least a 10% annual return on his investment 3) Fred plans to sell the business after 7 years. Based on his growth plan, a business consultant estimates that he will be able to sell the business for $500,000 at the end of 7 years. Carry out an appropriate discounted cash flow (DCF) analysis. Based on your DCF analysis, do you recommend that Fred buy this business? Give your reasons. Drawing a time line may help your thinking. 4) the 5% annual growth is only an estimate. Test the sensitivity of your conclusions if the growth rate is 3%, 4%, 5%,6%, and 7%. Fred, who retired early at 58 from a multi-national is considering buying a small business. He is evaluating buying a small wine store. The wine store that he is evaluating will cost him upfront $360,000, but he will get a business that is generating a positive cash flow from day 1. After shadowing the current owner for a month, Fred collected the following information. 1) The business is currently generating a positive net cash flow of $30,000 per year (assume all cash flows occur at the end of each year). By keeping slightly longer hours and keeping more inventory, Fred estimates he can increase that cash flow by 5% every year. So, from the very first year that he operates the business, he will be able to increase net cash flow annually by 5%. 2) Fred decided that he will buy the business only buy if he can get at least a 10% annual return on his investment 3) Fred plans to sell the business after 7 years. Based on his growth plan, a business consultant estimates that he will be able to sell the business for $500,000 at the end of 7 years. Carry out an appropriate discounted cash flow (DCF) analysis. Based on your DCF analysis, do you recommend that Fred buy this business? Give your reasons. Drawing a time line may help your thinking. 4) the 5% annual growth is only an estimate. Test the sensitivity of your conclusions if the growth rate is 3%, 4%, 5%,6%, and 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts