Question: Please use excel format and show cell calculations, thanks. The Project Consider the following scenario: Epsilon Products, Inc., (EPI) projects unit sales for a new

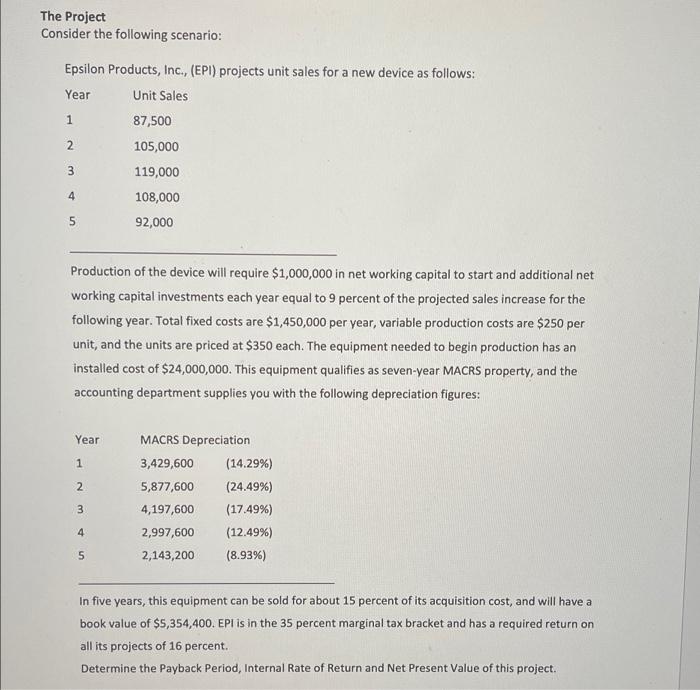

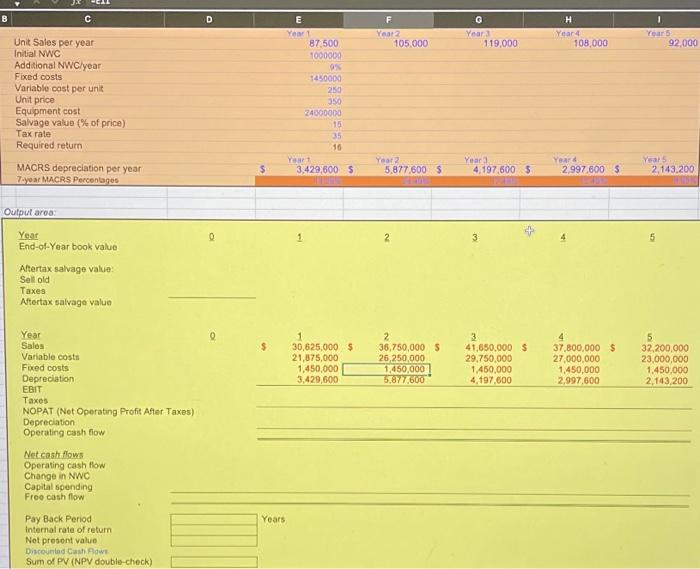

The Project Consider the following scenario: Epsilon Products, Inc., (EPI) projects unit sales for a new device as follows: Year Unit Sales 1 87,500 2 105,000 119,000 3 4 108,000 5 92,000 Production of the device will require $1,000,000 in net working capital to start and additional net working capital investments each year equal to 9 percent of the projected sales increase for the following year. Total fixed costs are $1,450,000 per year, variable production costs are $250 per unit, and the units are priced at $350 each. The equipment needed to begin production has an installed cost of $24,000,000. This equipment qualifies as seven-year MACRS property, and the accounting department supplies you with the following depreciation figures: Year 1 2 MACRS Depreciation 3,429,600 (14.29%) 5,877,600 (24.49%) 4,197,600 (17.49%) 2,997,600 (12.49%) 2,143,200 (8.93%) 3 4 5 In five years, this equipment can be sold for about 15 percent of its acquisition cost, and will have a book value of $5,354,400. EPL is in the 35 percent marginal tax bracket and has a required return on all its projects of 16 percent. Determine the Payback Period, Internal Rate of Return and Net Present Value of this project. B D Year 105,000 Years 119,000 H Year 4 108,000 Year 5 92,000 Unit Sales per year Initial NWC Additional NWC year Fixed costs Variable cost per unit Unit price Equipment cost Salvage value (% of price) Tax rate Required return E Yaart 87,500 1000000 9 1450000 250 350 24000000 15 35 10 YS 3,429,6005 MACRS depreciation per year Tayar MACRS Percentages Year 2 5,877,600 $ Year 4,197,600 $ Year 2.997,800 $ Years 2,143,200 Output area 0 1 3 Year End-of-Year book value 5 Altertax salvage valua: Sell old Taxes Aftortax salvage value Year Sales 0 $ 1 30,625,000 $ 21,875,000 1,450,000 3,429,600 2 36,750,000 $ 26,250,000 1,450,000 5,877,600 3 41,650,000 $ 29,750,000 1,450,000 4.197.600 4 37,800,000 $ 27,000,000 1,450,000 2,997,600 5 32,200.000 23,000,000 1.450,000 2,143,200 Variable costs Fixed costs Depreciation EBIT Taxes NOPAT (Net Operating Profit After Taxes) Depreciation Operating cash flow Net.cash flows Operating cash flow Change in NWC Capital spending Free cash flow Years Pay Back Period Internal rate of return Net present value Discounted Cash Flows Sum of PV (NPV double-check)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts