Question: Please use excel format and use the format given above Question 3. Company BMI will experience a supernormal growth rate of 20% in the next

Please use excel format and use the format given above

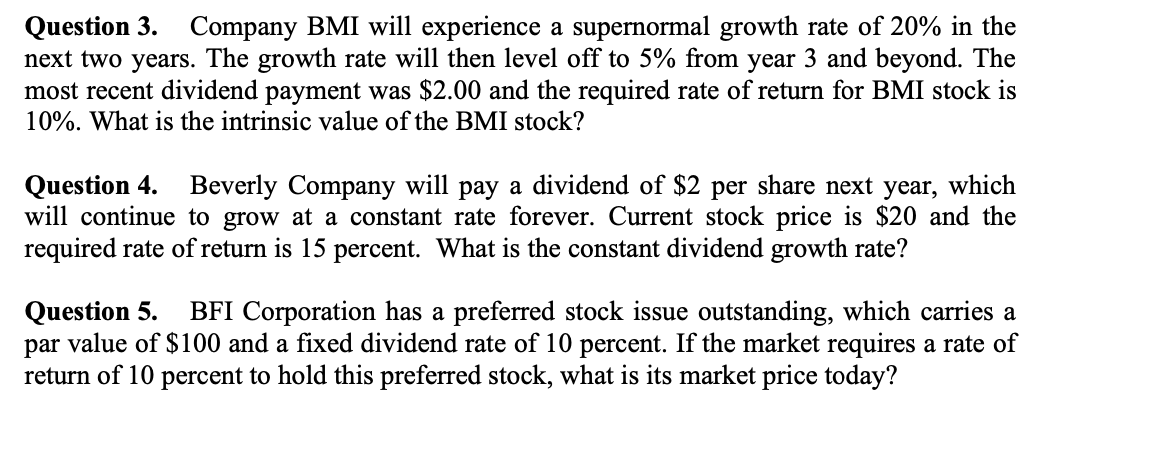

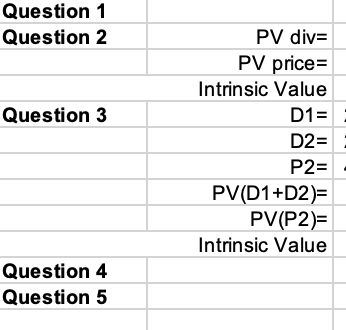

Question 3. Company BMI will experience a supernormal growth rate of 20% in the next two years. The growth rate will then level off to 5% from year 3 and beyond. The most recent dividend payment was $2.00 and the required rate of return for BMI stock is 10%. What is the intrinsic value of the BMI stock? Question 4. Beverly Company will pay a dividend of $2 per share next year, which will continue to grow at a constant rate forever. Current stock price is $20 and the required rate of return is 15 percent. What is the constant dividend growth rate? Question 5. BFI Corporation has a preferred stock issue outstanding, which carries a par value of $100 and a fixed dividend rate of 10 percent. If the market requires a rate of return of 10 percent to hold this preferred stock, what is its market price today? Question 1 Question 2 PV div= PV price= Intrinsic Value Question 3 D1 = D2 = P2= PV(D1+D2)= PV(P2)= Intrinsic Value Question 4 Question 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts