Question: **Please use excel format for solving with equations** (12-10) Capital Budgeting Methods Project S has a cost of $10,000 and is expected to produce benefits

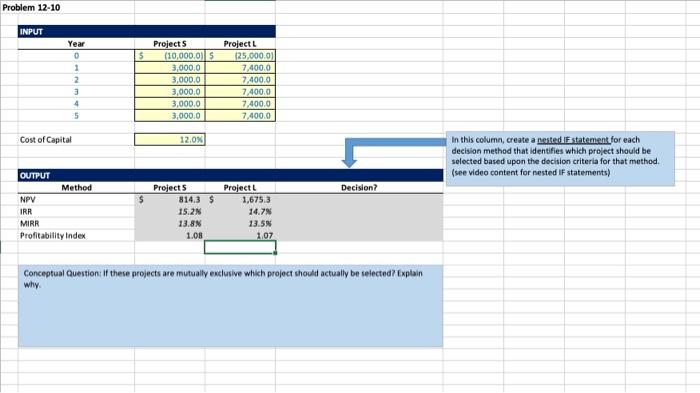

(12-10) Capital Budgeting Methods Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects' NPVS, IRRS, MIRRS, and Pls, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected? Problem 12-10 INPUT S Year 0 1 2 3 4 5 Projects (10,000.0l s 3,000.0 3,000.0 3,000.0 3,000.0 3,000.0 Project 125.000.0) 7.400.0 7.400.0 7.400.0 7.400.0 7.400.0 Cost of Capital 12.0% In this column, create a nested IF statement for each decision method that identifies which project should be selected based upon the decision criteria for that method. (see video content for nested IF statements) Decision? OUTPUT Method NPV IRR MIRR Profitability Index Projects 814.3 $ 15.2 13.8% 1.08 Project! 1,6753 14.7% 13.5% 1,07 Conceptual Question: If these projects are mutually exclusive which project should actually be selected? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts