Question: **Please use excel format for solving with equations** (12-7) NPV Your division is considering two investment projects, each of which requires an up-front expenditure of

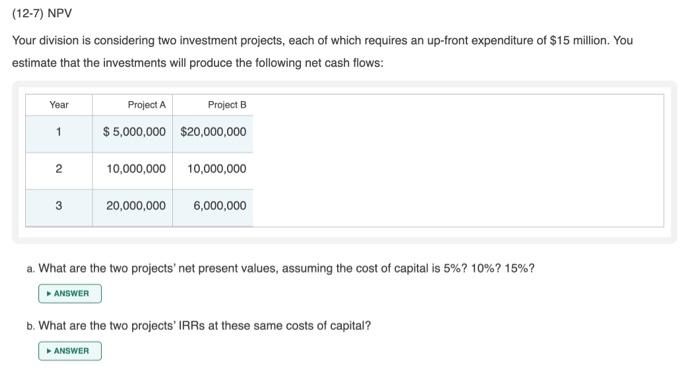

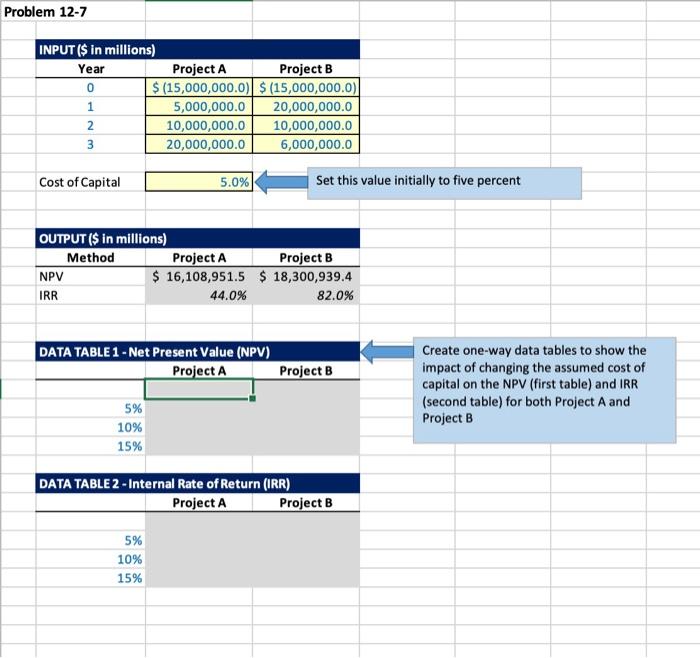

(12-7) NPV Your division is considering two investment projects, each of which requires an up-front expenditure of $15 million. You estimate that the investments will produce the following net cash flows: Year Project A Project B $5,000,000 $20,000,000 1 2 10,000,000 10,000,000 3 20,000,000 6,000,000 a. What are the two projects' net present values, assuming the cost of capital is 5%? 10%? 15%? ANSWER b. What are the two projects' IRRs at these same costs of capital? ANSWER Problem 12-7 INPUT ($ in millions) Year Project A Project B 0 $ (15,000,000.0) S (15,000,000.0) 1 5,000,000.0 20,000,000.0 2 10,000,000.0 10,000,000.0 3 20,000,000.0 6,000,000.0 Cost of Capital 5.0% Set this value initially to five percent OUTPUT ($ in millions) Method Project A Project B NPV $ 16,108,951.5 $ 18,300,939.4 IRR 44.0% 82.0% DATA TABLE 1 - Net Present Value (NPV) Project A Project B Create one-way data tables to show the impact of changing the assumed cost of capital on the NPV (first table) and IRR (second table) for both Project A and Project B 5% 10% 15% DATA TABLE 2 - Internal Rate of Return (IRR) Project A Project B 5% 10% 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts