Question: Please use excel format L A B C D E F G H 1 J 1 Health tax 2 16 marks 3 4 Below are

Please use excel format

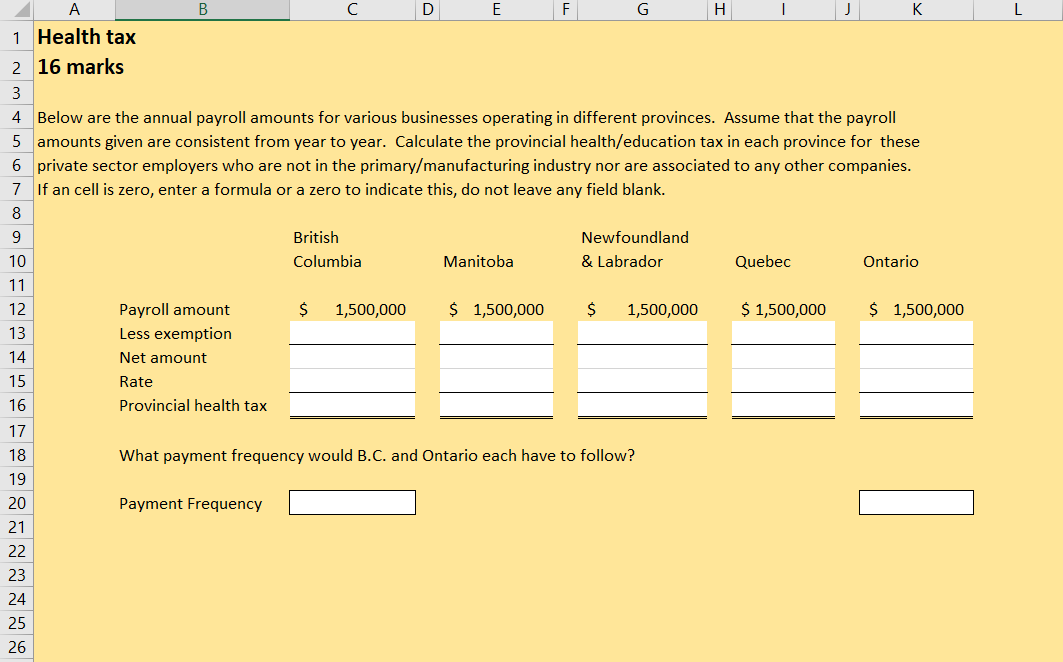

L A B C D E F G H 1 J 1 Health tax 2 16 marks 3 4 Below are the annual payroll amounts for various businesses operating in different provinces. Assume that the payroll 5 amounts given are consistent from year to year. Calculate the provincial health/education tax in each province for these 6 private sector employers who are not in the primary/manufacturing industry nor are associated to any other companies. 7 If an cell is zero, enter a formula or a zero to indicate this, do not leave any field blank. 8 9 British Newfoundland 10 Columbia Manitoba & Labrador Quebec Ontario 11 12 Payroll amount $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 13 Less exemption 14 Net amount 15 Rate 16 Provincial health tax 17 18 What payment frequency would B.C. and Ontario each have to follow? 19 20 Payment Frequency 21 22 23 24 25 26 L A B C D E F G H 1 J 1 Health tax 2 16 marks 3 4 Below are the annual payroll amounts for various businesses operating in different provinces. Assume that the payroll 5 amounts given are consistent from year to year. Calculate the provincial health/education tax in each province for these 6 private sector employers who are not in the primary/manufacturing industry nor are associated to any other companies. 7 If an cell is zero, enter a formula or a zero to indicate this, do not leave any field blank. 8 9 British Newfoundland 10 Columbia Manitoba & Labrador Quebec Ontario 11 12 Payroll amount $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 13 Less exemption 14 Net amount 15 Rate 16 Provincial health tax 17 18 What payment frequency would B.C. and Ontario each have to follow? 19 20 Payment Frequency 21 22 23 24 25 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts